Your Money is like Laundry

Whether you love it or hate it, you’ve got to deal with it.

Huge props to the 92 of you that jumped in to be a part of the ground level of intro. I can't thank you enough!

If this was forwarded to you, you can jump in by smashing the button below:

intro exists to make your life better by introducing you to great things and helping you implement them.

This week I want to introduce you to a way of approaching your money that will increase your confidence, ensure you're in control, provide a sense of peace knowing that all your bases are covered, and then give you the freedom to spend money without feeling guilty.

I’ll share the big idea with you today and give you the steps you’ll need to implement it later this week.

Here’s what we’ll cover:

The Challenge: Money is like Laundry

The Old-Fashioned, Manual Solution that's Rarely Used -- Budgets

A New Solution -- Your Automatic Money Robot

The Challenge: Money is like Laundry

Money is like laundry, whether you love it or hate it, you’ve got to deal with it. Everyone has an approach, habit, and way of relating to money.

Ideally, our approach to money is planned, organized, and perfectly synced with our values and dreams. It could look something like this...

And when our money is perfectly in our control, right where it's suppossed to be, we can can feel like this...

But the reality is that our money is often all over the place, doing a million different things. Sometimes we're aware, but often we've got little clue of what's going on. Life happens, days get long, the vending machine starts calling our name, whatever it is, our money begins look like this...

And all that jumbled mess of money makes us feel uncertain, vulnerable, sometimes even like this...

The challenge is that most people handle money in a way that makes them feel vulnerable, not confident. Anxious, not peaceful. Guilty, not free. Aimless, not purposeful.

Unfortunately...

The Old-Fashioned, Manual Solution is Rarely Used -- Budgets

The old-fashioned, manual solution was (and still is) to make a budget and then keep it. Unfortunately, budgets haven't stepped into the 21st century.

My grandparents were born and raised in India. My late Ammachy (a.k.a. grandma) grew up gathering her family's laundry, putting it in a basket, taking a long trek down to a river, and manually washing each article of clothing. She would smack the clothes against rocks, scrub each one with soap, and wring out the water. Then, after another long trek back home, the wet clothes would be hung to dry in the hot sun. This was hard, labor-intensive, exhausting work.

Then, they immigrated to the U.S. and eventually got a washing machine and dryer. Gone were the long, hard days of manual laundry. In was the easy, automatic life of a washing machine. Throw in dirty laundry, hang out for an hour, switch it to the dryer, and out comes clean, warm clothes.

Laundry (at least in the U.S.) has left the world of manual labor and has embraced automation...for the last 100 years.

Budgets, unfortunately, are stuck in the past.

Budgets are a really good solution to our money woes. Dave Ramsey has built an empire on it. Simply stated: You figure out how much money you make and then give every dollar a job. But there's just one problem: most people don't have the discipline, motivation, time or whatever to actually stick to a budget. Making a budget is relatively straight forward. Keeping a budget is a ton of work: organizing receipts, categorizing them correctly, ensuring the right transactions are made every month, and on and on it goes. Like a New Year's resolution, people wanting to stick to a budget start off at a sprint but usually fizzle out in a few months.

Most people fall into one of three camps when it comes to budgeting:

The Budget Committed: these folks are on top of it. They’ve got a budget, they use some method to ensure they’re staying in budget, and they follow it to a “T.” If you’re one of these folks, no need for you to read any longer. I’ll be back with another email in a few weeks. Thanks for stopping by.

The Budget Hopeful: these folks want to keep a budget. They think it’s a good idea. But once life starts happening, and the kids start throwing food and the work day extends a few hours past what was expected, the hopes of keeping a budget get tossed aside for a relaxing episode of The Office.

The Budget Haters: these folks won’t touch a budget with a ten-foot pole. They think that a budget is a good way to suck all the fun out of a room. They’d rather live their lives and allow the cards to fall where they may.

If you're in either one of those last two categories, let me introduce you to...

The New, Automatic Solution: Your Personal Money Robot

There's a better way: an automatic money robot.

Imagine a budget that’s always working for you in the background. And it's not just a budget on paper or in a spreadsheet, it's an actual money machine. Think of it as your own personal financial assistant that automatically ensures all your bills are paid, all your savings goals met, and all your generous hopes accomplished.

This money robot is yours for the taking. The cost? Free. Of course, it takes some time at the beginning to set everything up. (Imagine buying a washer and dryer and the process of hauling it to your house, wrestling it into your laundry area, taking it out of the box, and hooking it up.) The money robot has a setup at the beginning. But once set, it's automatic. No need for constant tracking and entering and finding receipts. It automatically puts everything in the right place and gives you a real-time indicator of what you have left to spend in key areas.

Here's what's even better, you can set the whole thing up from your house with an internet connection and a few hours. That’s it.

Convinced?

What is an Automatic Money Robot?

An automatic money robot takes the plan you create for your money and makes sure it’s accomplished. You set it up at the beginning, and it essentially works on it's own from that point on (with a few tweaks along the way).

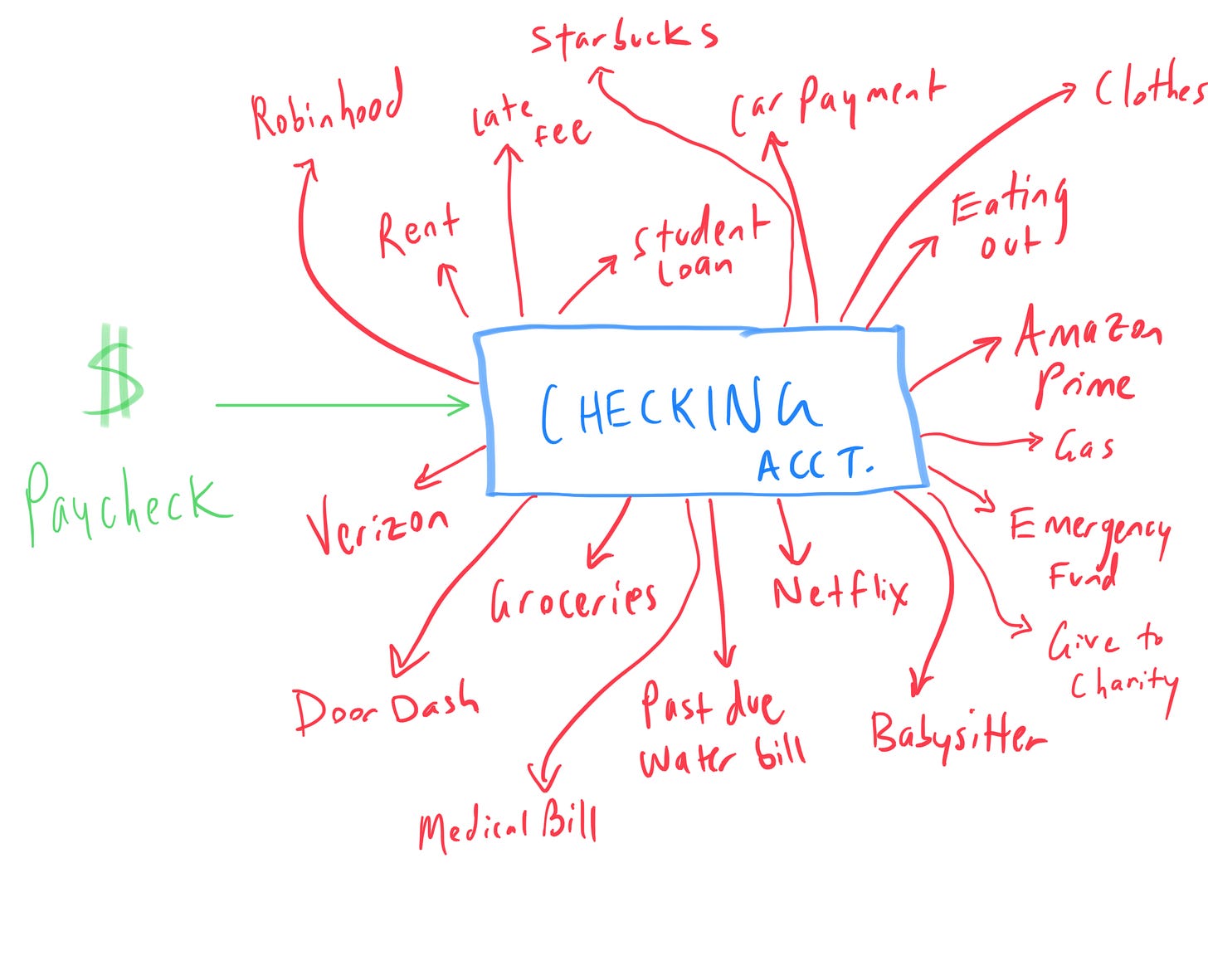

Most people's money currently looks like this:

Money flows in and out of one checking account. Since most people don’t keep up with their budgeting, their point of reference is the balance in their checking account. But, so much goes in and out of the account that it's virtually impossible to keep up with it all.

That leaves people feeling overly confident when they first get their paycheck and surprised later when their bills are due and they don't have much left.

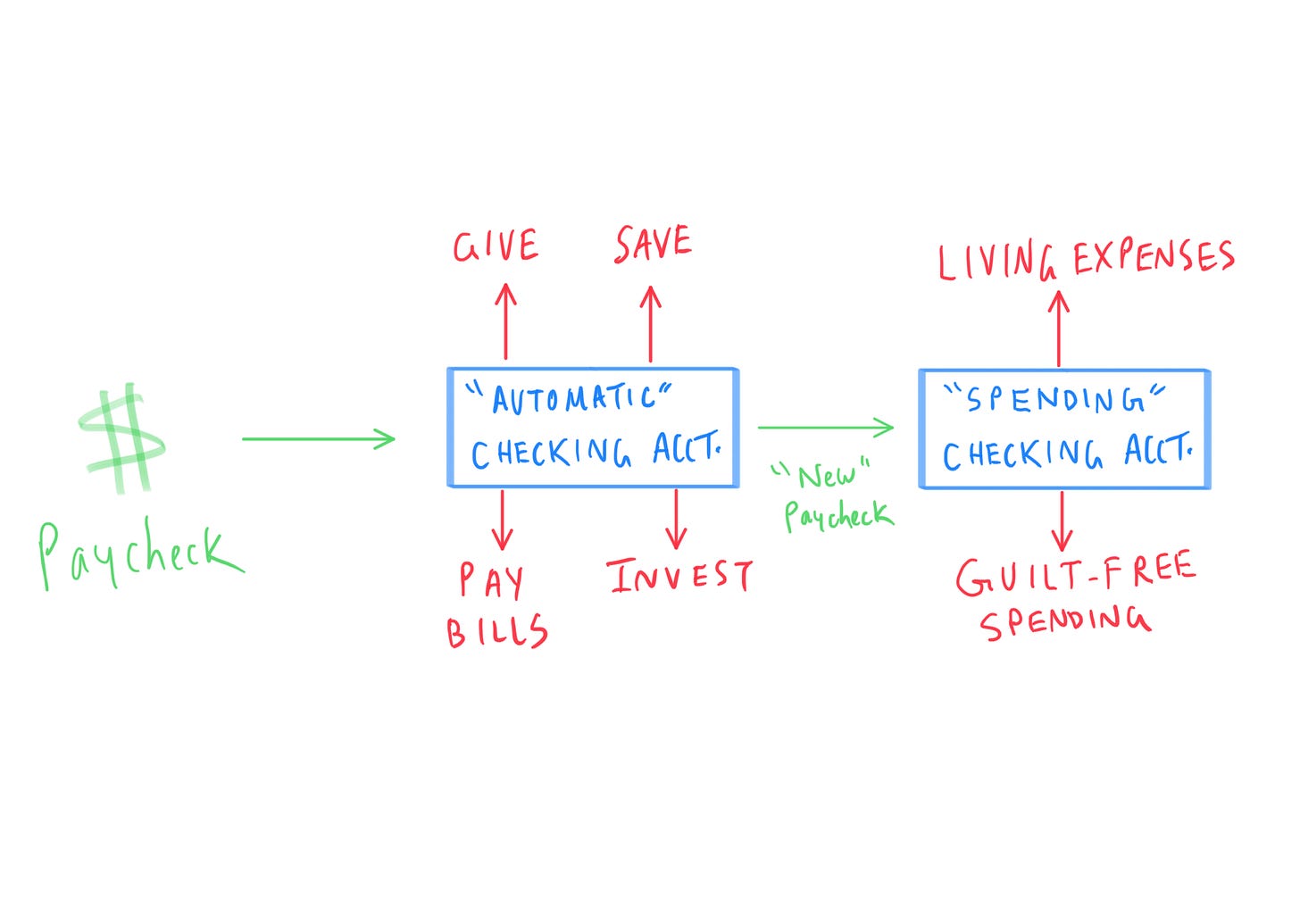

The automatic money robot is better. It looks like this:

All your money flows into the "Automatic" checking account. Big, important things like giving, saving, investing, and paying recurring bills automatically get done right from there. Then, with what's leftover, a "new" paycheck is transferred to the "Spending" checking account. All the money in this second checking account can be spent guilt-free on things like groceries, eating out, clothes, gas, and entertainment.

Later this week, I’ll send you step-by-step instructions to make your own automatic money robot.

A Better Future: Living Free and Confident with Money

When you've got a solid plan for money and a mechanism to keep your plan, the result is confidence and peace. And all this is happening automatically in the background as you go about your normal life.

Look out for another email this week with all the deets to make your life better with an automatic money robot.

Key Resources + Some Randomness

I'm indebted to the two articles below for much of what you see in this email.

"Automate your money: Build a system that saves while out sleep and pays your bills for you" By Remit Sethi. This article introduced me to the idea of setting up your money flow to be automated.

"Why a Hub Account is Key to Cash Flow" by Newleaf. This article took the idea above and made it even better by adding a second checking account.

My sense is that automated money will be the future. The first company I see taking significant strides towards this future is Wealthfront with what they call "Self-Driving Money." For a deep dive, check out their CEO talking about it here.

Writing is often linked to music. This update was largely written listening to The Joy of Being by Citizens. Altogether Good was my favorite song.

I always love feedback and perspective. If you've got thoughts, just hit reply and let me know.

And, want to intro me to something that's really helped you? Drop me a note.

Until Friday (or so),

Josh

PS Thanks to Ruthie for editing like a boss.