How to Make Your Own Money Robot

All the deets for your robot

Huge props to the 6 of you that jumped in since the last intro. You're joining a fun and curious community of 98 folks. I can't thank you enough!

If this was forwarded to you, you can jump in by lightly tapping the button below:

intro exists to make your life better by introducing you to great things and helping you implement them.

This email is a beast: step-by-step instructions and tons of details that get waaay into the weeds. But, by the end, you’ll have the game plan to gain control of your money and pursue your dreams by making your own money robot.

Here’s what we’ll cover:

A Quick Review: Budgets are Stuck in the Stone-Age

The Recipe to Create an Automatic Money Robot

A Few Tips and Tricks

A Quick Review: Budgets are Stuck in the Stone-Age

In the last email, I introduced the idea that money is like laundry, and we all have to find a way to deal with it. If you haven’t read it, take a sec to check it out.

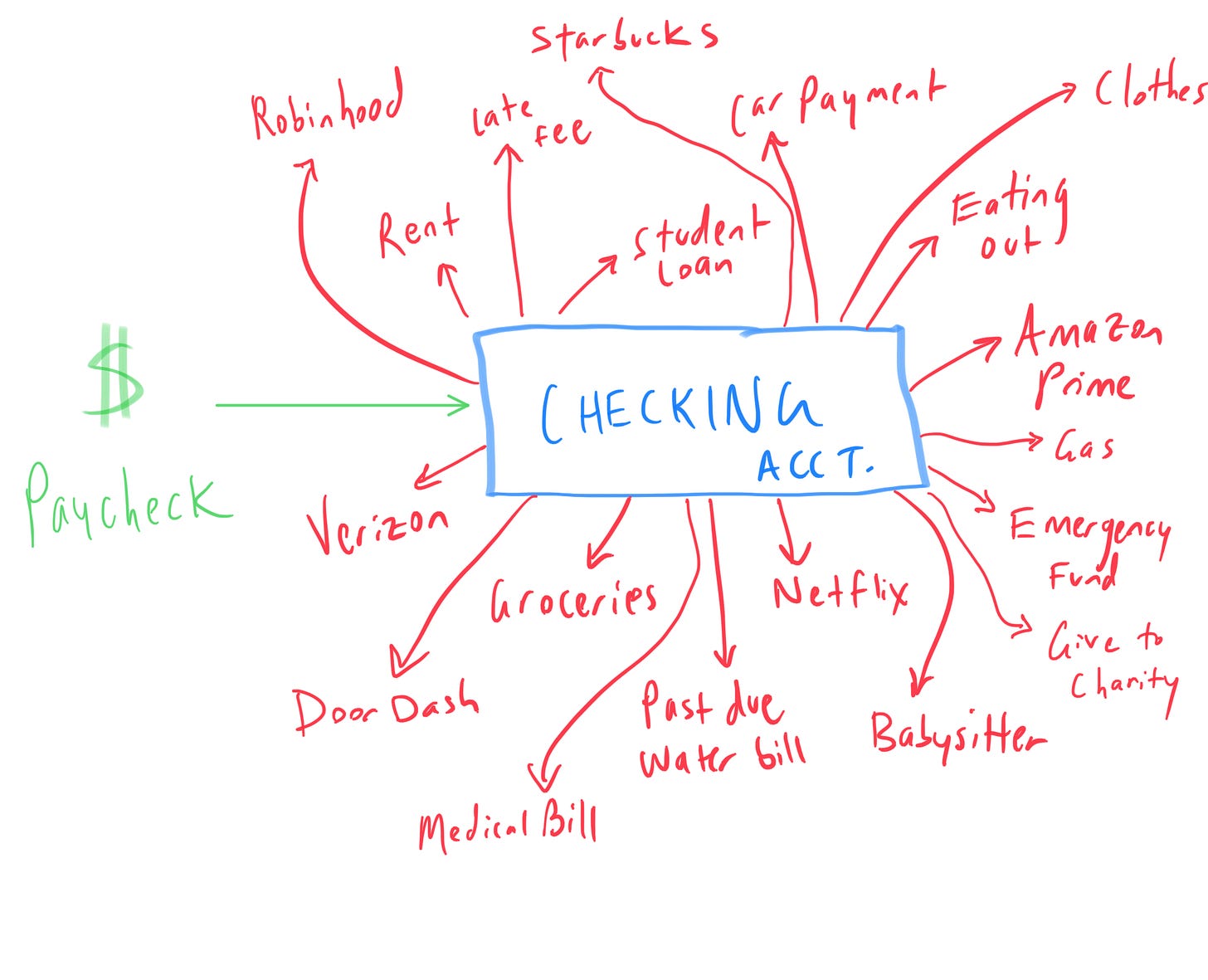

There’s just one problem: the leading solution -- making and keeping a budget -- is from the stone age. It’s manual, tedious, and requires constant attention, which leads most to drop it fast. Part of the problem is that everything wildly and randomly goes in and out of one account. It may look something like this...

All that tedious, stone-age budgeting combined with the crazy, free-for-all in your checking account decreases confidence, increases stress, and makes it hard to pursue your dreams.

But there’s a better way: your own automatic money robot. Your money robot takes the plan you create and automatically makes sure it gets done. You set it and then mostly forget it.

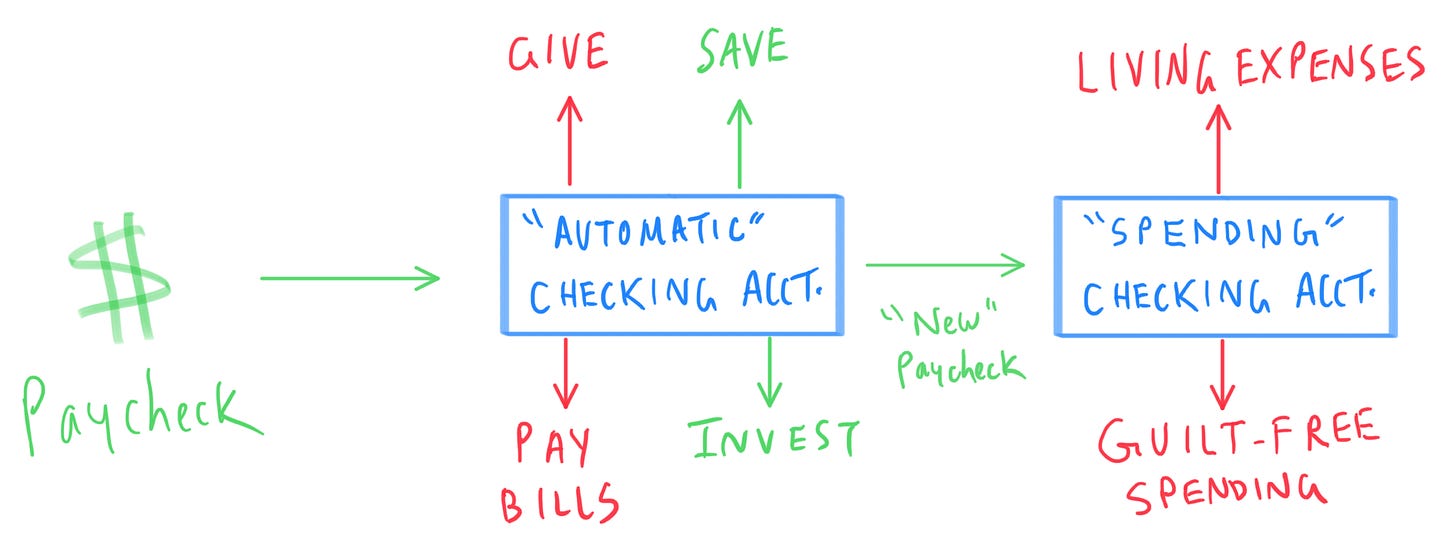

Your automatic money robot looks something like this…

In this email, I’ll show you how to implement it, a.k.a., give you step-by-step instructions to make your own automatic money robot.

The Recipe to Create an Automatic Money Robot

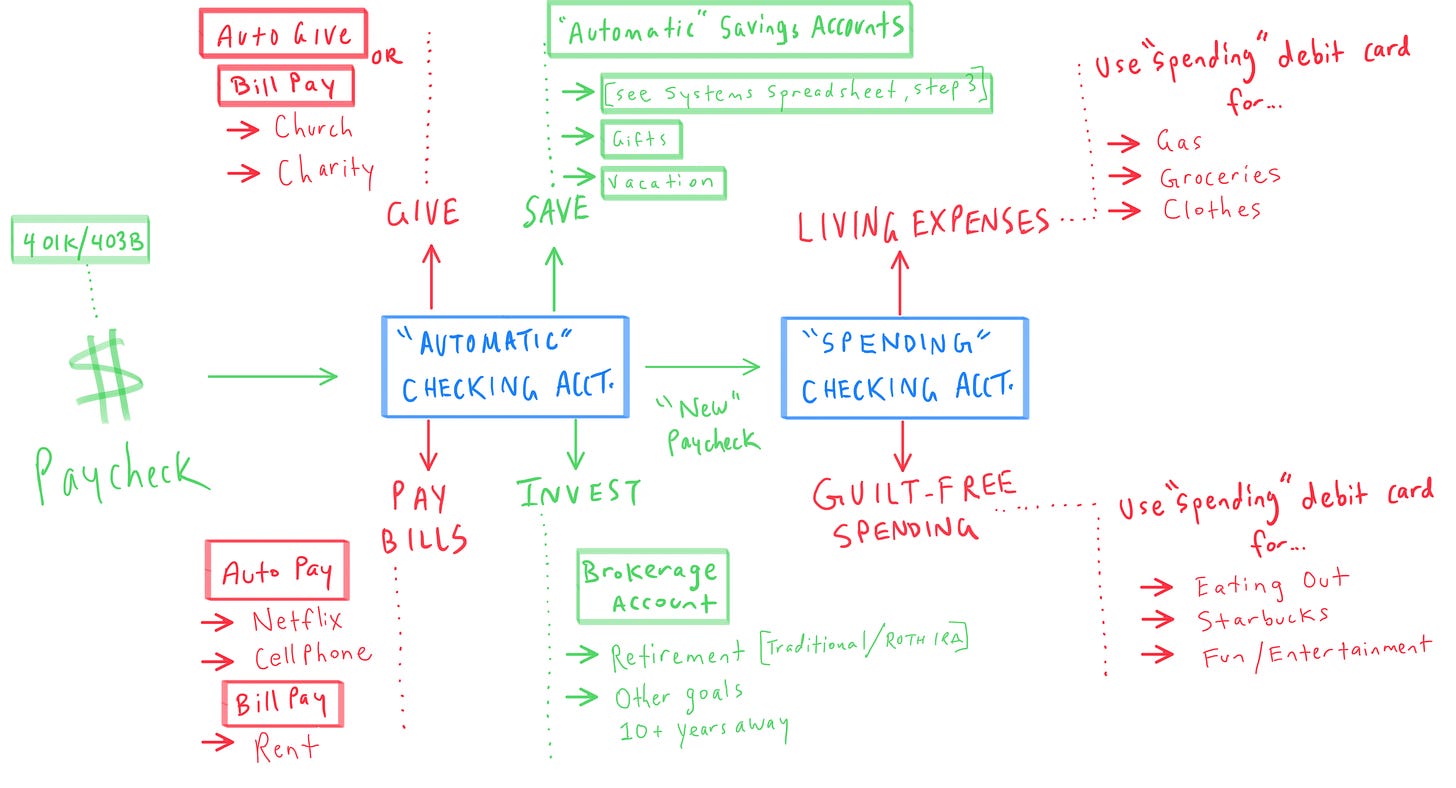

Want to see what your Automatic Money Robot will look like? Let's take a peek...

Click and zoom into the image if needed. Red is money going out. Green is money coming/staying in. All the boxes represent accounts or something to set up. The arrows are items related to that account.

Let's approach it like a recipe. First, gather all your "ingredients." This might take a hot minute. Once you’ve got your “ingredients” ready to go, set aside some time to work through the "instructions" below. Estimate roughly 3 hours.

By the end, you'll have created your own automatic money robot who will keep you on top of your finance goals, ensure you’re paying off your debt and saving for your dreams, all while you’re out there living your best life. Talk about confidence and peace of mind! All the important things are getting done in the background and you have the freedom to spend guilt-free.

Ready? Let's go!

INGREDIENTS

Income

Paystubs of your recent income. Note the frequency of your paychecks (e.g., biweekly, monthly)

Monthly Spending

Estimated amounts for your regular monthly spending. For example:

Charitable Giving

Utilities: Water, Electric, Gas

Credit Cards

Subscriptions

Mortgage/Rent

Loans: Student, Car, Medical, Other

Internet/Cable

Phone

Insurance: Home/Renters, Health, Life, Disability, etc.

Annual Spending

A copy (or guess) of all your spending that occurs at some point each year. For example:

Medical Expenses: Co-pays & Deductibles

Property Tax

Gifts

Car Registration

Car Insurance

Pets

Savings Goals

Make a list and take a guess at how much you’ll need to accomplish your goals. For example:

Short-Term Savings Goals (less than 5 years away)

Mid-Term Savings Goals (5-10 years away)

Long-Term Savings Goals (10+ years away)

Car

Vacation

Home Improvements

Kids' College Education

House Down Payment

(You will save for your long-term savings goals on step 5 of the Systems Spreadsheet below)

Logins to all your financial accounts (e.g., checking, savings, brokerage, etc).

You need two checking accounts.

One could be a local institution.

The other could be online (like Capital One). The key here is to have a bank account that has no fees and lets you open multiple savings accounts easily. If you don't have two checking accounts, you'll need to open a new one. This is critical.

Now that you’ve gathered up all your ingredients, pat yourself on the back, give yourself a high five and let’s build your robot.

INSTRUCTIONS

[1] Fill out theSystem Spreadsheet [<--click me]

This is where all the ingredients you gathered earlier will be organized. Follow the directions in the upper left corner of the spreadsheet to create your very own copy.

[2] Open an “Automatic” Checking Account

Ideally select an online bank, like Capital One 360, that has no fees and allows you to open multiple savings accounts under one name.

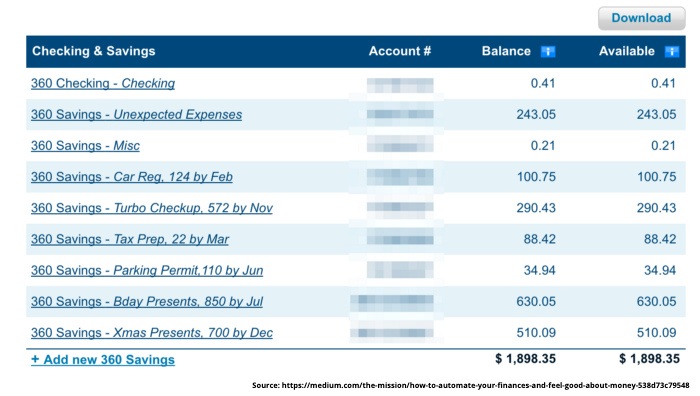

[3] Open “Automatic” Savings Accounts for Each of Your Annual Spending Items and Every One of Your Short-Term Savings Goals

Reference Step 3 in your System Spreadsheet. Your Automatic Bank Account could look something like this...

[4] Create Your “Spending” Checking Account

Ideally, use your local bank. This is your guilt-free "Spending" checking account. Whatever money comes into this account can be freely used for things like groceries, eating out, gas, clothes, and entertainment. Just be mindful, once it’s all used up, that’s it for the month.

[5] And now, without further ado… It's time to make your robot!

This step covers all the automatic transfers you need to set up.

A) If your employer offers any sort of matching for retirement, you've got to do your best to take advantage of it. This will come out of your paycheck before it gets deposited.

B) Reference your take-home pay in cell C7 on your System Spreadsheet. This is the amount that’s yours after taxes, insurance, and 401k contributions are taken out of your paycheck.

C) Direct deposit your paychecks into the “Automatic” checking account.

D) Create automatic transfers to each savings sub-account based on the frequency of your paycheck.

For example, if you get paid every two weeks, you’ll have 26 paychecks throughout the year. Take whatever savings goal amount you have (say $124 for car registration) and divide by 26. Then, every two weeks, create an automatic transfer for $5 to the car registration sub account. ($124/26 = $4.75. Round up to the next whole dollar.)

E) Create monthly automatic transfers to a brokerage account for long-term savings goals like retirement.

Want more detail about the stock market and saving for retirement? You’re in luck! Look out for a future intro email on this topic.

F) Set up each monthly bill, loan or giving contribution to be automatically paid from your “Automatic” checking account.

All your recurring bills will be paid in one of two ways. If your bill allows you to pay it directly from the company website, set up automatic payments to come from your “Automatic” checking account. For example, log into Netflix, go under Settings, and link your “Automatic” checking account to auto pay your Netflix.

If there isn’t a website to set up automatic payments, use the “Bill Pay” feature on your “Automatic” checking’s website. For example, if your rent needs to be submitted with a check, set up the Name, Address, and Amount of your rent check in the “Automatic” checking’s Bill Pay. Then, schedule it to be sent every month. Your bank will automatically write, cut, and mail a physical check on time, every time.

G) Calculate what you will have leftover each month after giving, saving, investing, and paying bills. If you have margin, leave an extra $500-$1,000 in your "Automatic" checking account. Then, create an automatic transfer of the leftover amount to the “Spending” checking account.

And now, my friends, your finances have finally entered the 21st century! Consider this your brand, spankin new money robot that’s going to put you in control of your money.

The beauty of the automatic money robot is that your spending decisions are isolated from your fixed expenses, loan repayment, giving, and savings goals. By isolating your day-to-day spending decisions in your “Spending” checking account, you always have a real-time idea of your budget status. So, if you end up eating out too much, you may need to pull back on clothes or groceries. Or, if you go on a shopping spree, you may need to eat out a bit less. Whatever way it goes, if you only spend what is in your “Spending” checking account each month, you'll always be in budget AND have confidence that all your other financial goals are being met.

A Few Tips and Tricks

--> Ideally, your “Automatic” checking account would always have one month’s worth of expenses. At the very least, aim for an extra $500-$1,000 in your “Automatic” checking account the first few months if possible. This will ensure any automations that aren't quite calibrated don't cause late fees.

--> If things are tight and you can't create a buffer in your “Automatic” checking account, you need to sync up your bills to your expenses. Here's what Remit Sethi recommends, assuming your paycheck is direct deposited on the 1st of the month:

1ST // Get all your bills to be dated the 1st of the month. You just call each one and ask them to change the bill date. It's usually pretty simple and takes about 5 minutes per company. Note that it may take a month or two to see these changes completed.

5TH // Make your short and mid-term savings (in Savings sub-accounts) and long-term savings (in a traditional, Roth, or brokerage account) automatically come out the 5th of the month.

7TH // Pay all your bills. This can be through the company’s website or by setting up Bill Pay (for things like rent to your landlord), as described above.

3RD and 17TH // Calculate what you will have left over after you automate all your short and long-term savings and paying your bills. Move half this amount on the 3rd and the other half on the 17th. This is assuming you get paid twice a month on the 1st and 15th.

Closing

We just went through the gauntlet. It’s a ton of info, but it’s worth it! You may skim it over and conclude it’s just way too complicated. But here’s the deal: if you're struggling or frustrated that you never seem to meet your financial goals, you need to do this. Yeah, it will take some work on the front end. But once you have it set up, you are good to go! Make 2021 the year your finances pivot from being all over the place to finally being under control and humming along like a well-oiled….robot. :) You'll look back in 12 months and thank yourself.

Key Resources + Some Randomness

I'm indebted to the two articles below for much of what you see in this email.

"How to automate your finances and feel good about money" by Matty Sallin. The Systems Spreadsheet and the screenshot of the numerous savings accounts above come from this article.

"Automate your money: Build a system that saves while ou sleep and pays your bills for you" By Remit Sethi. This article lays out a detailed game plan to sync all your income and expenses.

"Why a Hub Account is Key to Cash Flow" by Newleaf. The drawings were inspired by this article.

This update was largely built listening to Fractioned Heart by Gable Price and Friends. Thanks for the recommendation, Dave!

I always love feedback and perspective. If you've got thoughts, just hit reply and let me know.

And, want to intro me to something that's really helped you? Drop me a note.

Thanks for reading!

Until next month,

Josh

PS Once again, Ruthie edited like crazy.

PPS Did someone forward this to you? Subscribe here.