Invest Like a Boss # 1: Be Wealthy or Look Rich?

It's not a trick question. And you have to choose one.

Mad props to the 7 of you that have hopped in since the last intro. You’re now a part of a community of 116 folks that are smart, curious, and ready to get at it.

If you haven’t yet subscribed, there’s no better time than…right now.

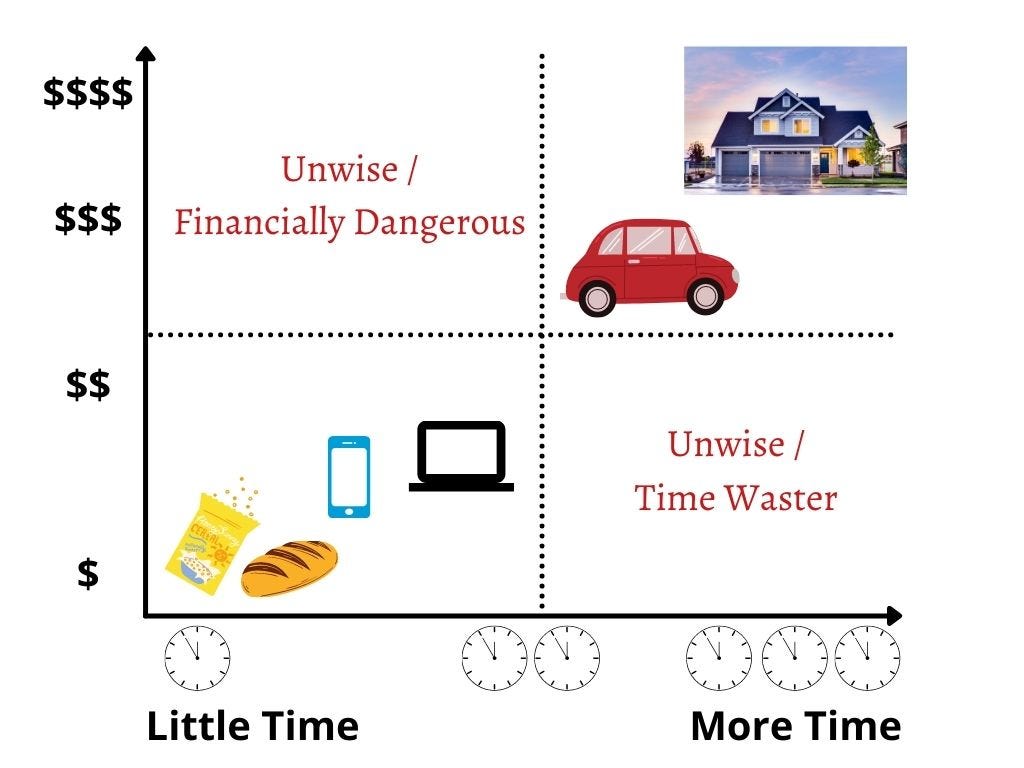

The way you go about buying a house is pretty different than how you buy cereal. Why? Well, cereal is relatively cheap, usually lasts a week or two, and really only helps you feel half-hungry in the morning. On the other hand, a house costs a ton of money, will last people anywhere from a few years to a few decades, and affects almost every facet of your life. So, of course, the way you approach buying a house is a whole different ball game than buying cereal. You’re going to do your homework, compare and contrast, ensure you understand what you’re getting into, work with other people to help you, and eventually settle on something that will be good for the long haul.

But there’s something even more valuable than a house, that usually spans several decades, that will affect every aspect of your life: where you live, how you live, your family, your career, your legacy, your freedom, and a whole host of other smaller and bigger things that fit in between. And yet, most give little to no attention to this area of life. For most, it falls into the top left square above. What is this important, yet overlooked arena? Investing in stocks and bonds.

There’s just one big problem...noise.

You’ve got talking heads confidently jabbering about the future (like they’ve been there and are coming back to tell us about it), professional finance people that often make money topics sound like a foreign language, and endless forms and documents that were seemingly drafted by a bunch of lawyers attempting to put you to sleep (by the way, I’ve got mad respect for the lawyers and finance pros I know).

Then there’s the noise of life. Bills and decisions, plans and schedules, taking the trash out and doing taxes while trying to teach your kid to use the toilet (this is hitting close to home).

Oh yeah, one more thing. There are things inside of you that make noise: emotions.

Our emotions can be all over the place with money. Money can make us feel anxious and fearful, excited and safe, even oddly compelled and controlled. When it comes to money, our emotions can be on a roller coaster.

All that noise, both outside and inside you, over the course of your life can lead many to throw up their hands and give up, ignore it, and forget about it.

But it doesn’t have to be that way. You can learn to invest like a boss.

Over the next few emails, we’re going to cover some serious ground. Here’s where we’re headed:

Why Invest: Being Wealthy > Looking Rich

Digging, Standing or Climbing? What Stage are You in?

Prereqs

The Approach: Boring > Flashy

Getting Started: Definitions, Accounts, and Funds

The Secrets of Investing

We’ll cover the first two in this email.

By the end of this series, you’ll be able to invest better than 90% of the population. You’ll know exactly where you’re at now and the next step to start building wealth. You’ll get both the big picture and the details, a vision for the good life and step-by-step guide to get there financially.

Let’s get started.

WHY INVEST: BEING WEALTHY > LOOKING RICH

There’s an ancient wise saying that goes:

One pretends to be rich, yet has nothing; another pretends to be poor, yet has great

wealth.1

Would you rather be wealthy or look rich? No, it's not a trick question. And yes, those are two different things.2

Wealth is what you don't see. Looking rich is what you do see.

Wealth is money saved. Looking rich is money spent.

A person driving down the street in a brand new car looks rich, but may actually be broke. A person driving down the street in a beater may look poor, but may actually be wealthy.

Looking rich is often dictated by what other people think (e.g., “I’ll buy this thing because people will be impressed with it”). Wealth is often dictated by your values (e.g., “I’ll save this to pursue my dreams” or “I’ll donate there because I believe in what they’re doing”).

Morgan Housel puts it like this:

Spending money to show people how much money you have is the fastest way to have less money… The only way to be wealthy is to not spend the money that you do have. It’s not just the only way to accumulate wealth; it’s the very definition of wealth.3

This approach to wealth may appear boring and mundane, but produces a life that has freedom, margin, and plenty. Looking rich may appear flashy and exciting, but often produces a life that is confined, tight and wanting.

On this journey to invest like a boss, the very first choice you have to make is whether you want to be truly wealthy or appear rich. You only get to pick one, so really consider your decision.

Why you’re investing, to be truly wealthy or appear rich, will dictate how you invest. Who you want to be will determine what you do.

Before getting too far, let’s figure out where you’re at right now.

DIGGING, STANDING, OR CLIMBING?

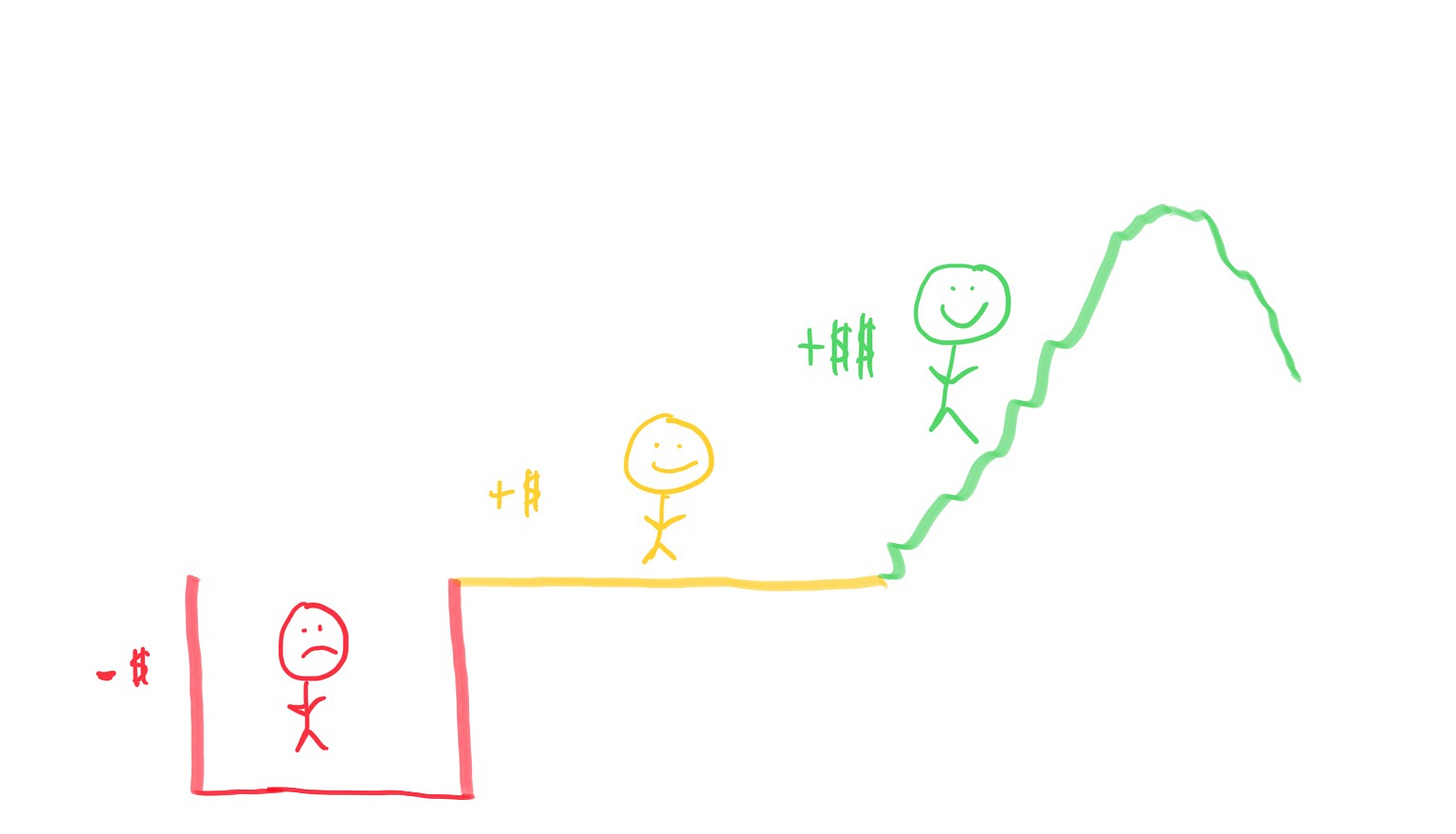

Digging a hole. Standing on ground. Climbing a mountain.

When it comes to your money, you're likely in one of three situations. You're either digging a hole, standing on ground, or climbing a mountain. Think about which best describes your current situation.

Digging a hole (a.k.a. I'm in or accumulating debt)

You're spending more than you earn and/or taking out non-mortgage debt (think student loans, credit cards, auto loans, medical debt, etc). Most college students are in this category, but many of us find ourselves in all sorts of debt well after our school years.

Standing on ground (a.k.a. figuring this money thing out)

You're spending less than you earn, paying off debt, and saving for an emergency fund (at least $1,000 in a savings account for emergencies). You’re fully out of the hole and on level ground once all debt (except a mortgage) is paid off and your emergency fund has increased from $1,000 to whatever it would take to float your life financially for three months.

Climbing a mountain (a.k.a. approaching or already building wealth)

You’re spending less than you earn and that margin is going towards long-term goals. You’re climbing the mountain as money is saved and growing consistently over time.

So, roughly, where are you at?

(que Jeopardy music)

If you're either in the hole or standing on ground, pay close attention to the “Prerequisites” section in a future email. But if you're beginning to think about building wealth, over the next few months you’re going to learn how to invest super well.

Now that you know where you’re at, let’s close this down with some good news and bad news.

The Good and Bad News of Investing

The good news first:

You can invest like a boss. It's possible. And no, you don't have to have a bunch of letters behind your name or carry around a TI 89 for fun.

And, for the bad news:

Investing like a boss is so simple that you'll be tempted to ignore it. You’ll think to yourself, “There’s got to be more here. It has to be more complex. If it was this easy, anyone could do it.” Well, yes, anyone can invest well, with just a few concepts and tools in place.

CLOSING UP

There’s lots to come in the next few weeks, but for now, you have two things to figure out so you can hit the ground running:

Would you rather be wealthy or look rich?

Identify which category best describes your financial situation: digging a hole, standing on ground, or climbing a mountain?

Before you can invest like a boss, you’ve got to work these things out. So take a few minutes, talk to your spouse if you’re married, and get ready for round two in a week or so.

Until then, I always love feedback and perspective. If you've got thoughts, just hit reply and let me know.

SOME RANDOMNESS

Check out the music video for Lecrae’s song, “Fakin.” It’s funny and hits a bit on the theme of looking rich.

Thomas Stanley’s New York Times Bestseller, The Millionaire Next Door, deepens the argument that many of the wealthy people in the United States don’t live in mansions or drive fancy cars.

The article “Hockey Has a Gigantic-Goalie Problem” by Ken Dryden. It reminds me of Michael Lewis’ The Blind Side and Moneyball. Small changes over time can dramatically change an entire sport.

Want to intro me to something that's really helped you? Drop me a note.

Catch you later,

Josh

PS Did someone forward this to you? Subscribe here.

It’s from the Bible, in a book aptly titled Proverbs (and if you really want to find it, it’s in chapter 13 and verse 7).

Morgan Housel, in his book The Psychology of Money really made the distinction between these two categories click for me.

The Psychology of Money, 95, 98.