The Tripping Stock Market

What to do when the market dips 10% (or more!)

After an extended break, intro is back! Get ready for a new season of posts covering stocks, the housing market, and maybe even a bit on crypto. Feel free to share intro with other folks looking to dominate life.

If you haven’t subscribed, there’s no better time than right about now.

The stock market has been doing crazy things the last decade and especially the last few years. The graph below is from 2009-2022.

Source: Yahoo Finance

In case you couldn’t tell what was happening, I just added in the green arrow. Looks about as close to a rocket ship as possible, especially the last few years.

For perspective, if you bought $100 of an S&P 500 Index Fund, like SPY, in March 2009, you’d have $644 today. Take that in: a boring investment would have returned over 6x!

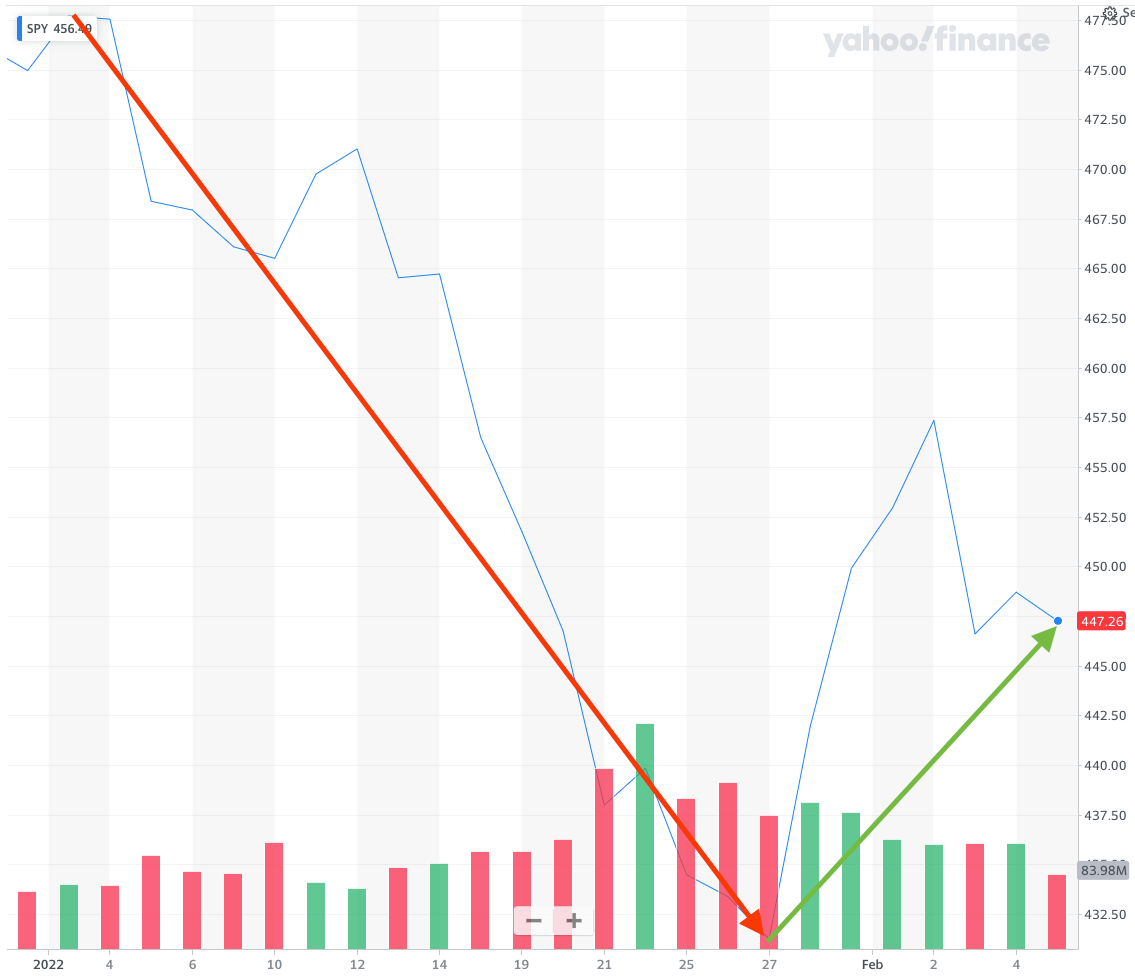

But, since the start of 2022, here’s what the chart looks like:

Source: Yahoo Finance

Whenever things go down, it can feel dramatic. Most media make it feel like the world is falling apart.

All humans (yes, even the most cerebral of us) are emotional. Losing money is really, really hard. In fact, there’s a whole arena of study called loss aversion that essentially concludes that a person losing $100 loses more satisfaction than the same person will gain satisfaction from making $100. Losing money hurts.

When we start seeing the market dip, and our nest egg dwindle, our emotions get a megaphone and scream: “SELL, SELL, GET OUT BEFORE IT GET’S WORSE!”

But that usually is the worst thing to do. Here’s a better way:

Remind yourself when you need that money. Most people that have money in the stock market are investing for a future goal, often retirement. If you’re not planning on actually using the money in years, maybe even decades down the road, just chill. You don’t need it today so it doesn’t matter what it’s worth today.

Ignore Almost All Media. Seriously, don’t worry about whatever person on TV or what some influencer is predicting. They have no clue what’s going to happen tomorrow. No one does. So getting all tangled up and anxious because some person is predicting the end of the world does no one good.

Think of market dips like sales. Usually a decline of 10% in the market is understood as a 10% loss. That’s true. But it could also be thought of as a 10% sale. What was once $100 is now $90. That’s a pretty good discount. If things dip even more, like in the 20% or even 30% range, think of it as an all-out clearance!

If you have margin, buy. What do most people do when their favorite thing is on sale? They buy it. Same thing with the market, if you’ve got margin in your budget, get in more.

Keep doing the same thing. If you have money in the market, you are likely doing the prereqs (paying off debt, living below your means, saving). Keep saving and putting money into the market consistently.

That’s a wrap for now. Keep on holding.

Josh

Further Reading

Ben Carlson at A Wealth of Common Sense has become one of my favorite analytical observers of the market. His article, “This is Normal” is a nice supplement to market dips.

Basically anything Morgan Housal writes is good. His short article, “When the stock market plunges, keep your head on a swivel” is a helpful reminder that these dips are part of the cost of investing.