Invest Like a Boss # 2: Prereqs

You're starting somewhere...as a human

Mad props to the 3 of you that have hopped in since the last intro. You’re now a part of a community of 119 folks that are smart, curious, and ready to get at it.

If you haven’t yet subscribed, there’s no better time than…right now.

intro exists to make your life better by introducing you to great things and helping you implement them.

You’ve made it to Part 2 in a series called Invest Like a Boss! We’re cutting through the noise to discover how to invest in the stock market….really well.

In part 1 (catch it here if you missed it, it’s essential reading), there were two key questions to answer:

Do you want to be wealthy or look rich?

Are you financially digging a hole, standing on ground, or climbing a mountain?

Your answer to the first question will help uncover why you’re investing, which determines how you invest.

Your answer to the second question is your starting point, where you’re at right now.

The series will progress as follows:

Why Invest: Being Wealthy > Looking Rich [Part 1]

Digging, Standing or Climbing? What Stage are You in? [Part 1]

Prereqs

The Approach: Boring > Flashy

Getting Started: Definitions, Accounts, and Funds

The Secrets of Investing

This week we’re on #3, Prereqs. We’ll dive into where you’re at right now and ensure you're positioned to invest well over the long haul.

I remember hating the first lesson of any new sport in gym class. It was a day of running through rules and barely playing the game. Today’s kind of like that: before we can think about investing, we’ve got to be sure to have the Prereqs covered. You might be itching to get to the juicy details of some hot stock tip, but if the Prereqs aren’t in place, the whole investing thing can come crumbling down.

We’re going to make two moves today:

Get on Solid Ground

Embrace being a human

GET ON SOLID GROUND

If investing is climbing a mountain, the first thing you've got to do is stop digging a hole. Accumulating debt and spending more than you earn are sure fire ways to not invest or invest poorly. If you have any kind of debt (other than a mortgage), do all you can to eliminate it. Here's the quickest way out:

See your debt as a problem. Debt’s like a leech, sucking away your hard earned money. You may not feel it at first, but over time, debt has a way of crippling your life. Make it your aim to rip debt out of your life.

Do everything you can to reduce your expenses and increase your income. Pretty simple here: earn more money and spend less of it.

Organize your debt from the lowest balance to the highest. Use this paper form or website.

Pay the minimum required for all your loans.

Take any extra money and put it towards the smallest debt.

Once the smallest debt is paid off, take all the money that you were putting towards the smallest debt, combine it with what you're already paying on the second debt, and go after debt #2 with all you got.

Repeat until all the debt is gone.

This is called the Debt Snowball and it's seriously worked for millions of people.

If you're in debt, this is going to be tough. But the mindset, work ethic, and discipline needed to get out of debt, is exactly what's going to accelerate your investing. So think of paying off your debt as the required training necessary to kill it as an investor.

As you climb out of the debt hole or if you’re already out, get a budget. You can do a paper budget. Or you can set up your own money robot. A real, working budget is the quickest way to find weak spots in your spending habits, create margin, and have the extra needed to invest like a boss.

No matter where you’re starting from, you’ve got to get to solid ground (3 month emergency fund, no debt other than the mortgage, and consistently spending less than you earn) to be positioned to start investing well.

And, you’ve got to embrace being a human.

EMBRACE BEING A HUMAN

I’m 100% sure that you are a human. Yep, captain obvious here. When it comes to investing like a boss, you've got to embrace your humanity and use it to your advantage. You must come to terms with things you can and can’t control. So, let’s cover a few:

You can't control the past

The past is the past. It's over. And yes, the things we did in the past do affect us today, but you can't go back in time. In business it's called a sunk cost. There's no use beating yourself up about what you should or shouldn't have done. What good is it going to do anyways? You can, of course, learn from the past. But there’s no going back.

You can't control the future

While we're at it, you can't control the future either. You don't know what's going to happen with some company or the economy or a country or the world. I mean, if 2020 has taught us anything it's that anything can happen. So, don't get caught up trying to figure out if the market is going to go up, down, left or right. Honestly, you're not going to know for sure (and, the reality is, no one knows).

You can control the present

There actually is something you can control. It's the present. It's where you are right now. You have the ability to make choices that will impact you now and into the future. So, no matter what has happened in the past (which you can't control) and what will happen in the future (which you can't control either), it leaves you with the critical space, right now, to make decisions that will make your life better.

You can control how you invest

Here we go now. We all have an approach to investing (by the way, not investing is an approach). If investing is climbing a mountain, there are a lot of different trails. The trail you choose will affect the journey and final destination. The way you choose to go about investing will affect your life now and later.

You can control the kinds of investments you purchase.

If you want, you can put all your money in one stock (p.s., this is a very bad idea!). Or, you can spread your money around. A diversity of funds ensures that if a few do poorly, there are others that may be doing well to balance it out.

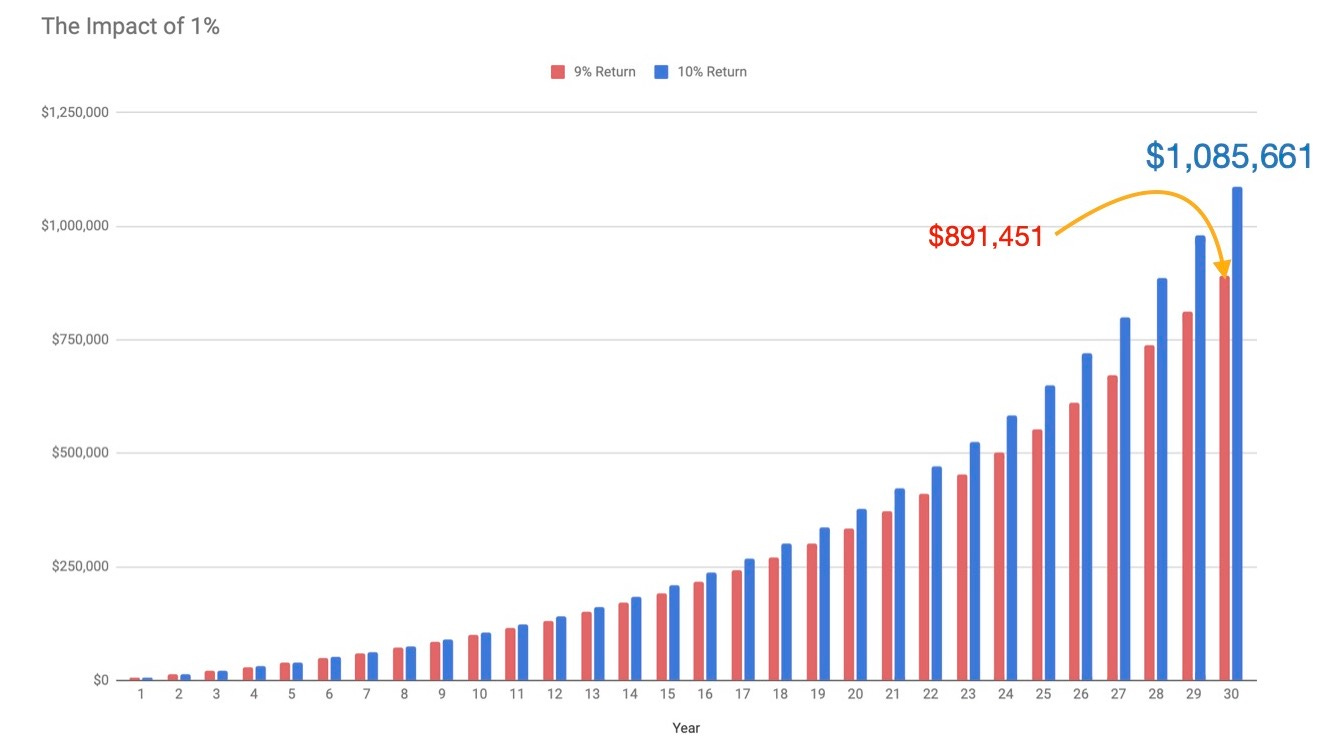

You can control how much you pay for investing (a.k.a. fees).1

Why in the world are we talking about fees?! We’re talking about fees?! Not investing? Fees!

Seriously. Look, they may seem minuscule but have massive effects over time.

Just like everything in life, there are more expensive and less expensive funds. One fund could have several types of fees. So be mindful of the fees and clear about what you’re paying for upfront. All this information is public, but it can be hidden.

For fun, let me show you the massive impact of a 1% fee. 1%. Doesn’t seem like much, right? I mean, what difference could a measly 1% make?

Let’s say you’re just starting to invest. You’ve got $0 put away. But you’re geared up, so you’re dropping $500/month into investments for the next 30 years. If you average 10% return each year, you’ll have a whopping….

$1,085,661

You’d be a millionaire!

But what if you averaged 9% return, assuming all the same stuff earlier. No big deal right. It’s just 1% less. Well, you’d have...

$891,451

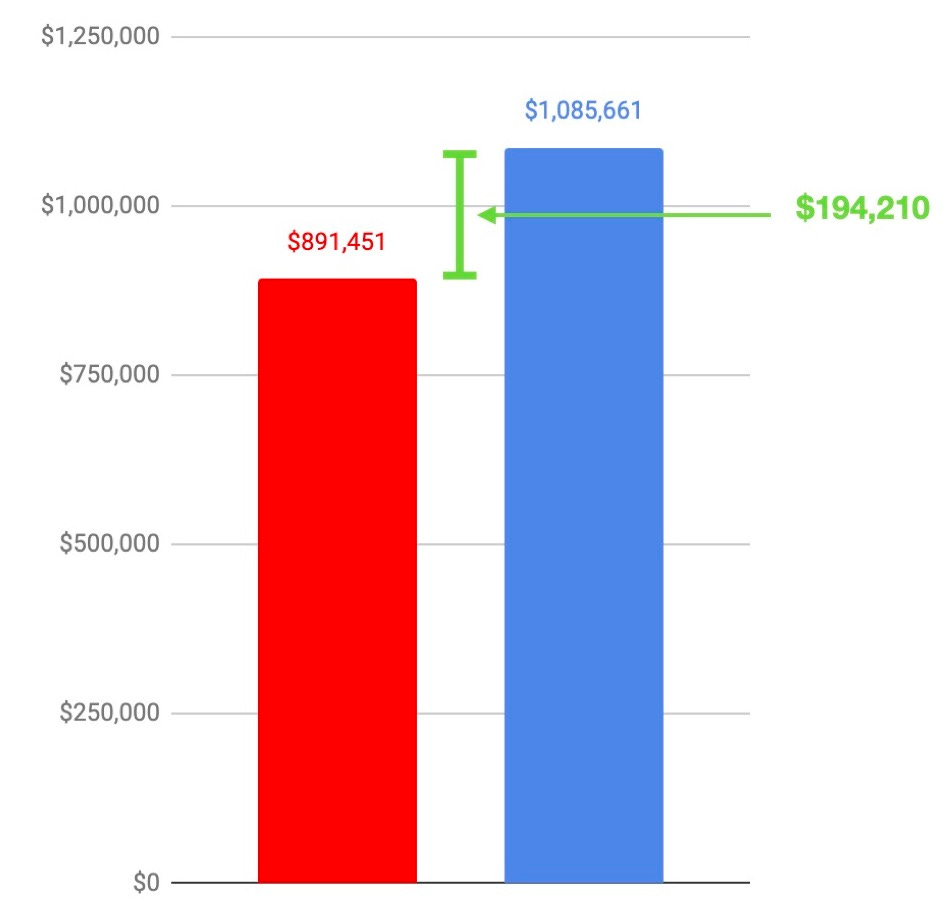

That’s still a lot of money. But did you notice the difference just 1% made? Here’s a close up of those last two bars:

$194,210.

You’d have nearly $200k less just because of a 1% difference. Your next egg would be almost 20% less!

You can control how much you save.2

Hold up, don’t rush past this one. Your savings rate (the percentage you save of your income) is way more important than fees or what return you’re getting on your investments. Seriously, WAAAY more important. It’s why people who make lots of money can end up with way less wealth than people who make less money but save more. Something like 78% of NFL athletes are bankrupt after two years of retirement.3 On the flip side, check out the remarkable story of this guy, Ronald Read.

Savings rate is all about lifestyle. For most, as income increases, so does lifestyle expenses. Which leaves very little for savings and investing. On the flip side, if you know what enough is, as income increases, expenses stay the same, building more and more for things like investing.

We are all limited, finite human beings. And that’s a wonderful thing. Enjoy it, embrace the confinements. And then move forward.

CONCLUSION

Prereqs aren’t usually fun, but they’re essential. Get on stable financial ground and embrace being a human. If you get these two things down, you’re off to the races to climb the mountain of investing like a boss.

Next email, we’ll finally cover two approaches to investing: the boring and the flashy.

Talk soon,

Josh

CLOSING RANDOMNESS

I watched Allen Iverson’s infamous “Practice!” video writing this post. It’s one of those classic videos that is still quoted. But then I read a post that argues that Iverson was likely drunk and certainly grieving the death of his best friend.

30 for 30, “Broke” Documentary. It’s a startling and honest look at athletes that go make a fortune playing professional sports but go broke shortly after retiring.

I’ve loved Judah & The Lion’s “Spirit” this past month. The song alone makes me want to see the Mighty Ducks new series.

Warren Buffet sends an annual letter to his investors. In 2016, he had one of the best explanations as to why people willingly pay more money for an inferior product. Here’s the full quote:

Over the years, I’ve often been asked for investment advice, and in the process of answering I’ve learned a good deal about human behavior. My regular recommendation has been a low-cost S&P 500 index fund.

To their credit, my friends who possess only modest means have usually followed my suggestion. I believe, however, that none of the mega-rich individuals, institutions or pension funds has followed that same advice when I’ve given it to them. Instead, these investors politely thank me for my thoughts and depart to listen to the siren song of a high-fee manager or, in the case of many institutions, to seek out another breed of hyper-helper called a consultant.

That professional, however, faces a problem. Can you imagine an investment consultant telling clients, year after year, to keep adding to an index fund replicating the S&P 500? That would be career suicide. Large fees flow to these hyper-helpers, however, if they recommend small managerial shifts every year or so. That advice is often delivered in esoteric gibberish that explains why fashionable investment “styles” or current economic trends make the shift appropriate.

The wealthy are accustomed to feeling that it is their lot in life to get the best food, schooling, entertainment, housing, plastic surgery, sports ticket, you name it. Their money, they feel, should buy them something superior compared to what the masses receive. In many aspects of life, indeed, wealth does command top-grade products or services. For that reason, the financial “elites” – wealthy individuals, pension funds, college endowments and the like – have great trouble meekly signing up for a financial product or service that is available as well to people investing only a few thousand dollars. This reluctance of the rich normally prevails even though the product at issue is –on an expectancy basis – clearly the best choice.

My calculation, admittedly very rough, is that the search by the elite for superior investment advice has caused it, in aggregate, to waste more than $100 billion over the past decade. Figure it out: Even a 1% fee on a few trillion dollars adds up. Of course, not every investor who put money in hedge funds ten years ago lagged S&P returns. But I believe my calculation of the aggregate shortfall is conservative.

Much of the financial damage befell pension funds for public employees. Many of these funds are woefully underfunded, in part because they have suffered a double whammy: poor investment performance accompanied by huge fees. The resulting shortfalls in their assets will for decades have to be made up by local taxpayers.

Human behavior won’t change. Wealthy individuals, pension funds, endowments and the like will continue to feel they deserve something “extra” in investment advice. Those advisors who cleverly play to this expectation will get very rich. This year the magic potion may be hedge funds, next year something else. The likely result from this parade of promises is predicted in an adage: “When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.”

Morgan Housal, Psychology of Money, 103

Tim Parker, “Why Athletes Go Broke.”