Invest like a Boss #3: Boring > Flashy

It's better to be simple, lazy and cheap than complicated, involved and expensive.

So glad for all 119 of you subscribing to this newsletter. If you find it helpful or entertaining or…well, anything, it would mean a ton if you’d share it.

If you haven’t yet subscribed, there’s no better time than right now.

intro exists to make your life better by introducing you to great things and helping you implement them.

You’ve made it to part 3 in a series called Invest Like a Boss! We’re cutting through the noise to discover how to invest in the stock market…really well.

Part 1 posed the serious question: are you investing to be wealthy or look rich? The answer will help you understand why you’re investing. Part 2 covered the prereqs, the key things that have to be in place to invest well. If you missed them, I’d highly recommend jumping back to part 1 and part 2.

The series will progress as follows:

Why Invest: Being Wealthy > Looking Rich [Part 1]

Digging, Standing or Climbing? What Stage are You in? [Part 1]

Prereqs [Part 2]

The Approach: Boring > Flashy [Right now!]

Getting Started: Definitions, Accounts, and Funds

The Secrets of Investing

This week we’re on #4, The Approach: Boring > Flashy. Back in part 1, I shared anyone can invest like a boss, but it’s so simple, may I say boring, that you’ll be tempted to ignore it. Today, you’re going to be put to the test.

Here’s what we’ll cover in this email:

The Boring and Flashy Approaches to Investing

Why Boring > Flashy

Why You’ll be Tempted to Ignore this Advice

Determine Your Goals to Determine Your Path

THE BORING AND FLASHY APPROACHES TO INVESTING

Investing is like climbing a mountain. You’ve got to determine why you’re climbing (being wealthy or appearing rich), which will determine how you climb (boring or flashy approach).

Often, a person looking to be wealthy will be inclined towards the boring approach. And, a person looking to appear rich will be inclined towards the flashy approach.

The boring approach to investing is simple, lazy and cheap. The flashy approach to investing is complicated, involved, and expensive. Let’s unpack how the two approaches are different.

Simple > Complicated

The boring approach to investing is simple. The flashy approach to investing is complicated.

Simple means it makes sense, it’s straightforward and understandable. The boring approach to investing is predictable and planned. Based on your goals (which we’ll get to in a bit), the boring approach lays out a simple plan of investing in stocks and bonds. That’s about it.

Unfortunately, investing seems to be one of those areas where people like to make it seem super complicated. Some finance experts make you feel like this whole investing thing is way above your pay grade and needs to be outsourced...to the expert. What with options and shorts, buying and selling, bears and bulls, market caps and P/E ratios, it’s all just too complicated to understand.

Lazy > Involved

The boring approach to investing is lazy. The flashy approach to investing is involved.

The boring approach is essentially to set it and forget it. Figure out your goals, find the right ratio of funds, put money in every month, and forget about it (I’ll cover all this before the end of the series).

The chart below captures it well. The top investor is flashy. The bottom is boring.1 Think of each emoji on the bottom chart as money put into the market each month.

And the effect of this consistency is captured best by Jack Bogle, the founder of Vanguard,

When you get your retirement plan statement every month, don’t open it. Don’t peek. When you retire, open the statement and believe me if you’ve been putting money in there for 40 or 50 years, you’ll need a cardiologist standing by you when you open it.

But being lazy doesn’t seem to make sense. Usually the person working hard in life gets farther ahead than the person sitting around twiddling their thumbs. When it comes to investing, it can seem like the guy constantly checking their Robinhood account, reading up on the coolest stock, and talking about buying and selling the latest and greatest company must be killing it. They usually aren't! In fact, they almost never are. Why? Constantly buying and selling stocks is expensive (not just because of the potential fees, but because of the tax consequences), risky (you never know when the perfect time is buy and sell), and consuming (once you get into being actively involved, you have to constantly pay attention).

The best lazy investors know that one of the greatest contributors to long-term wealth is: time in the market. Simply having money in the market for the long-haul ends up having the best returns. For example, Warren Buffet is currently worth about $101 billion. Yes, staggering. But do you know how much he was worth at 65, just 25 years ago? $3.1 billion.2

My head can’t compute that kind of growth. Much of Buffet’s success is that he invests for the long-term and doesn’t freak out and sell when things get rough.

The best lazy investors know that it’s really hard to do better than everyone else (a.k.a. the market) once. It’s almost impossible to beat the market consistently over a long period of time.

Involved investors may put too much stock into their own ability to see into the future (p.s., no one knows the future). They may do endless amounts of research into a company or wonder if they should switch their strategy over and over. But, at the end of the day, all this time and effort yields little to no advantage.

In fact, investing is one of the few times in life where it’s better to be lazy than involved. It’s better not to work. Got that? Set it and forget it > work, work, work.

Cheap > Expensive

The boring approach to investing is cheap. The flashy approach to investing is expensive.

The dramatic effect of fees was already covered in part 2 (if you missed it, just a 1% fee could be the difference of $200,000).

Nothing is free, especially investing. There are fees and costs all over the place. But the financial industry is smart, they don't tell you how much you're paying in dollars, but instead in percentages. When you see something costs 1% it feels like nothing. To make this worse, it's not just a one-time fee, it's ongoing (like forever). The higher your fees, the better your investment has to do to just break even.

Think of someone running the 100 yard dash but having to start 10 yards behind the starting line. They would be at a huge disadvantage to the other racers. Why? Because they've got to make up 10 yards just to be in the same spot as everyone else. That's what high fees do to investments. It automatically sets you back. Instead, low cost investments are actually superior. It doesn't set you back and they're usually really simple (see simple > complicated).

WHY BORING > FLASHY

The boring approach to investing uses your goals to determine a ratio of stocks and bonds to buy consistently over time. It takes a planned amount of money and puts it away on a predictable schedule, regardless of what the news is saying, month in and month out for decades.

The flashy approach to investing often disregards goals and invests in the hottest stock in fits and spurts, over a sporadic period of time. The goal is to buy low and sell high, but often the flashy approach ends up buying high and selling low.

Overall, the boring approach is far superior in nearly every way: in the long-term, you’ll accumulate more money, in less hands-on time, with little stress. Or would you rather have less money, waste more time, and have a bunch of stress?

Boring is better than flashy because you’ll make more money in the long run.

Boring is better than flashy because it will take you less hands-on time.

Boring is better than flashy because it will be far less stressful.

WHY YOU’LL BE TEMPTED TO IGNORE THIS ADVICE

Regardless of all that’s been said, the flashy approach to investing is really enticing because we all have FOMO and want things now. Let’s unpack these two things.

FOMO (Fear of Missing Out)

No one likes missing out on good things. I’m sure you’ve had the feeling of regret when you look down at what you’ve ordered at a restaurant and compare it with your friend across the table. You know you’ve made the wrong choice and it stinks.

Well, things are amplified when it comes to money. When everything is going well and it seems like the whole world is getting richer, you don’t want to miss out on the rocket ship. Often, more educated investors start taking risks that they normally wouldn’t take. This can lead to a whole range of bad decisions, including putting money in completely fraudulent ventures.3

Now

Olive is our cute 2 1/2 year old that says things like “I want a snack…now.” I don’t think she realizes how rude it sounds (at least I hope not). The reality is that we all feel this way. We’ve been conditioned to assume things just work…like right away. Can you imagine how you’d feel if it took 2 minutes for your browser to open up (for those of you who remember AOL, you know how that feels)? Or, what if your Amazon order took a week to deliver? Pandemonium.

The flashy approach to investing can give you that validating feeling of making money now. It’s really fun to feel like you doubled your money in a week. Again, take a close look at the emojis on the top line. Look at those emotions.

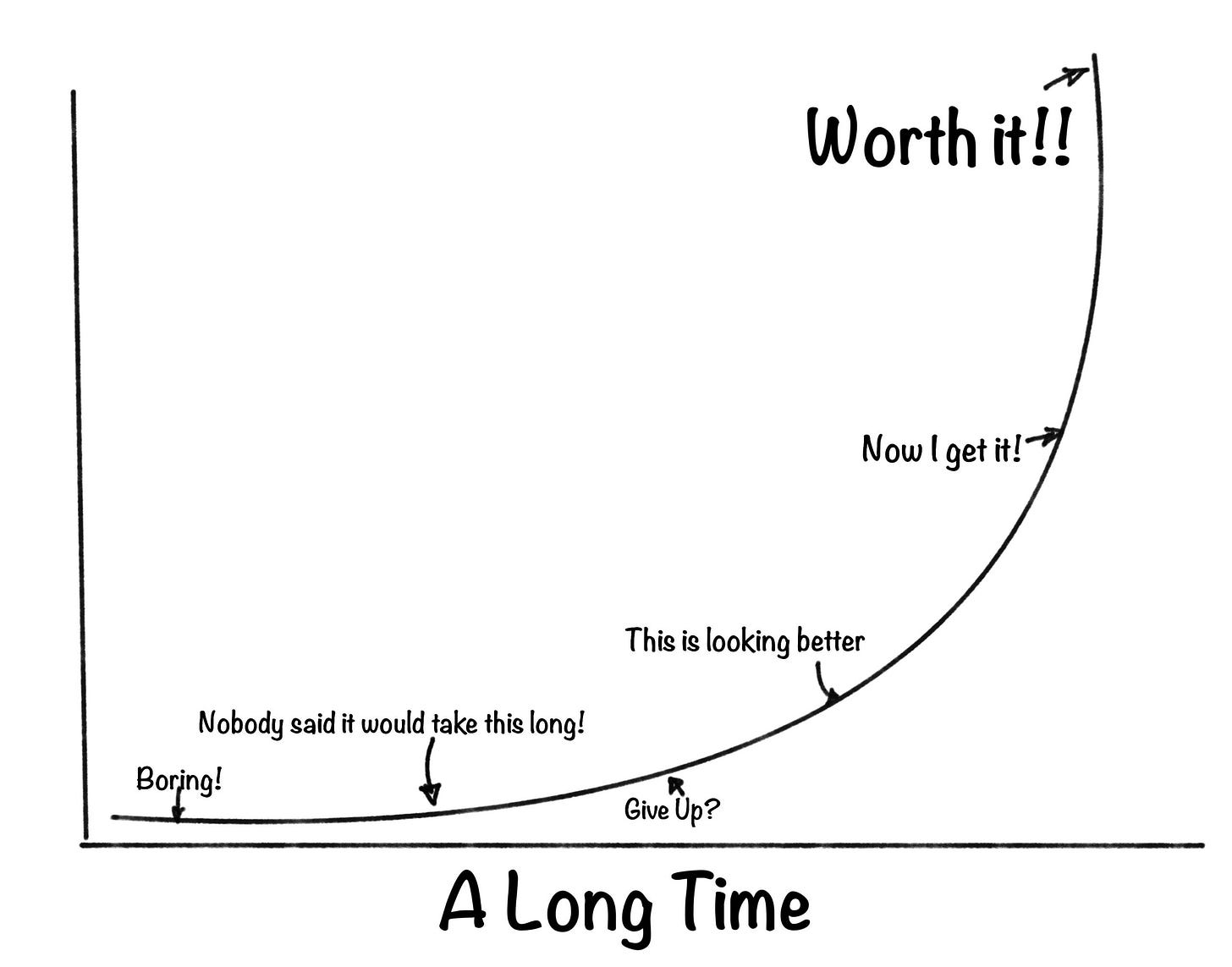

The results of the boring approach usually take decades and feels like this:

Your approach (boring or flashy) is how you invest. I’m hoping you’re convinced that the boring approach to investing is far better than the flashy approach. There’s just one more step before we can get climbing.

DETERMINE YOUR GOALS TO DETERMINE YOUR PATH

Before we can effectively climb the wealth-building mountain, it is critical to define your goals. Your goals are like your trail guide, helping determine your best route. Choosing the boring approach sets the tone of how you’ll climb the mountain. Determining your goals will determine what steps you’ll actually take.

Every goal has four elements that needs definition:

What is your goal?

How much money do you need for the goal?

When does the money need to be available?

How much risk are you willing to take? (low, medium, high)

Your risk capacity is partially based on personality, but should mostly be based on time frame (see #3 above). The longer the time frame, the more risk you can take (because there’s time to recover if the market goes down). The shorter the time frame, the less risk you should take (because the deadline may come before a recovery). A rule of thumb for risk is:

<5 years = little to no risk (use a savings account)

5-10 years = low/medium risk

11-20 years = medium/high risk

21-50 years = high risk

Every goal has to have a name, an amount, a timeframe, and a risk capacity. These create the trail guide of your climb: name, amount, timeframe, risk. Behind these four elements are deep values, hopes, and dreams. To invest wisely, these four components have to be defined, even if it’s a rough guess.

There are tons of goals a person may have. Let’s look at a few examples:

Goal: Buy a house

Amount: $40,000 for a 20% downpayment on a $200,000 house.

Timeframe: Five years

Therefore, Risk = Low

Goal: Retire

Amount: $1,000,000

Timeframe: 35 years

Therefore, Risk = High

Goal: Buy a Car

Amount: $7,500

Timeframe: 2 years

Therefore, Risk = None

So define your goals. The more detailed, the better.

NEXT STEPS

We’ve covered some ground today:

Which approach will you take: boring or flashy? Why?

Define your goals. Name it, determine the amount, timeframe, and risk capacity.

CONCLUSION

Alright all, we’re on the brink of climbing the wealth-building mountain. We’ve covered who you want to be (wealthy or appear rich), how you want to invest (boring or flashy), and which trail you want to take (based on your goals). Next time, we’re going to put it all together and get started. I’m talking stocks and bonds and fund recommendations. The whole nine yards! Can’t wait!

CLOSING RANDOMNESS

I’m not huge on financial advisors, but one of my favorites out there is Alan Roth. You can check out some of his stuff here and sign up for his newsletter if you’re really into it here.

The Simple Path to Wealth by JL Collins. What I’m putting together here is partially inspired by this book. If you want a one stop shop to see his work, buy the book. If you want to read all the blog posts that ended up becoming the book, get started here.

Got questions? Want to intro me to something you’re loving? Hit reply and drop me a note.

Ben Carson summed it up well in his article, “The Golden Age of Fraud is Upon Us.”

Morgan Housal’s Psychology of Money, page 45.