Invest Like a Boss #4: Getting Started!

Let's buy some funds...or at least one!

Thanks for diving into the intro community. If you know any other smart and curious folks, make my day by inviting them along!

If you haven’t yet subscribed, there’s no better time than right now.

intro exists to make your life better by introducing you to great things and helping you implement them.

**Disclaimer: This is not investment advice. I personally invest in the funds and companies mentioned below. There’s one affiliate link too.**

You’ve made it to part 4 in a series called Invest Like a Boss! We’re cutting through the noise to discover how to invest in the stock market…really well.

We’ve covered some crazy ground.

Who do you want to be? Wealthy > Appearing rich.

Do you have the Preqs done? In other words, are you out of debt, have a 6 months emergency fund, and spending less than you earn?

How will you invest? Boring > Flashy.

What are you investing for? Define your goals. Name them, Determine the amounts, timeframes, and Risk tolerances.

Getting Started: Definitions, Accounts, and Funds [Today!]

The Secrets of Investing

Today, we’re finally going to get started investing!!

Here’s how we’ll break it down:

Get a feel for the Terrain (a.k.a. defining stocks, bonds, mutual funds, etc.)

Define and triage the Packs you have available (a.k.a. 401k, IRA, etc.)

Get Your Own Pack (a.k.a. open a brokerage account)

Fill your Pack (a.k.a. The one-fund and two-fund options to buy)

[1] Get a Feel for the Terrain (a.k.a. defining stocks, bonds, mutual funds, etc.)

Look, I'm pretty sure a bunch of people in the financial industry got together and said, let's make this stuff as complicated as possible so that people feel confused and frustrated. Then, they'll hand all their money over to us and we'll make bank.

I'm here to cut through all the junk so you can actually understand what it all means and know how to progress. You're not just going to see the terrain, you're going to really understand it so you know how to navigate it like a boss.

One caveat: investing in stocks and bonds have risks. The comments below are generalized statements about stocks and bonds, over time. It doesn’t mean that this is what a stock or bond will do in any given year. Please be mindful that stocks and bonds can unexpectedly go up and down and that there is always risk in investing.

Stock

A stock is ownership in a company. It’s sometimes called a “share” or “equity.” When you own a stock, you own a piece of the company. For example, if you own one Apple stock, you own a sliver of Apple.

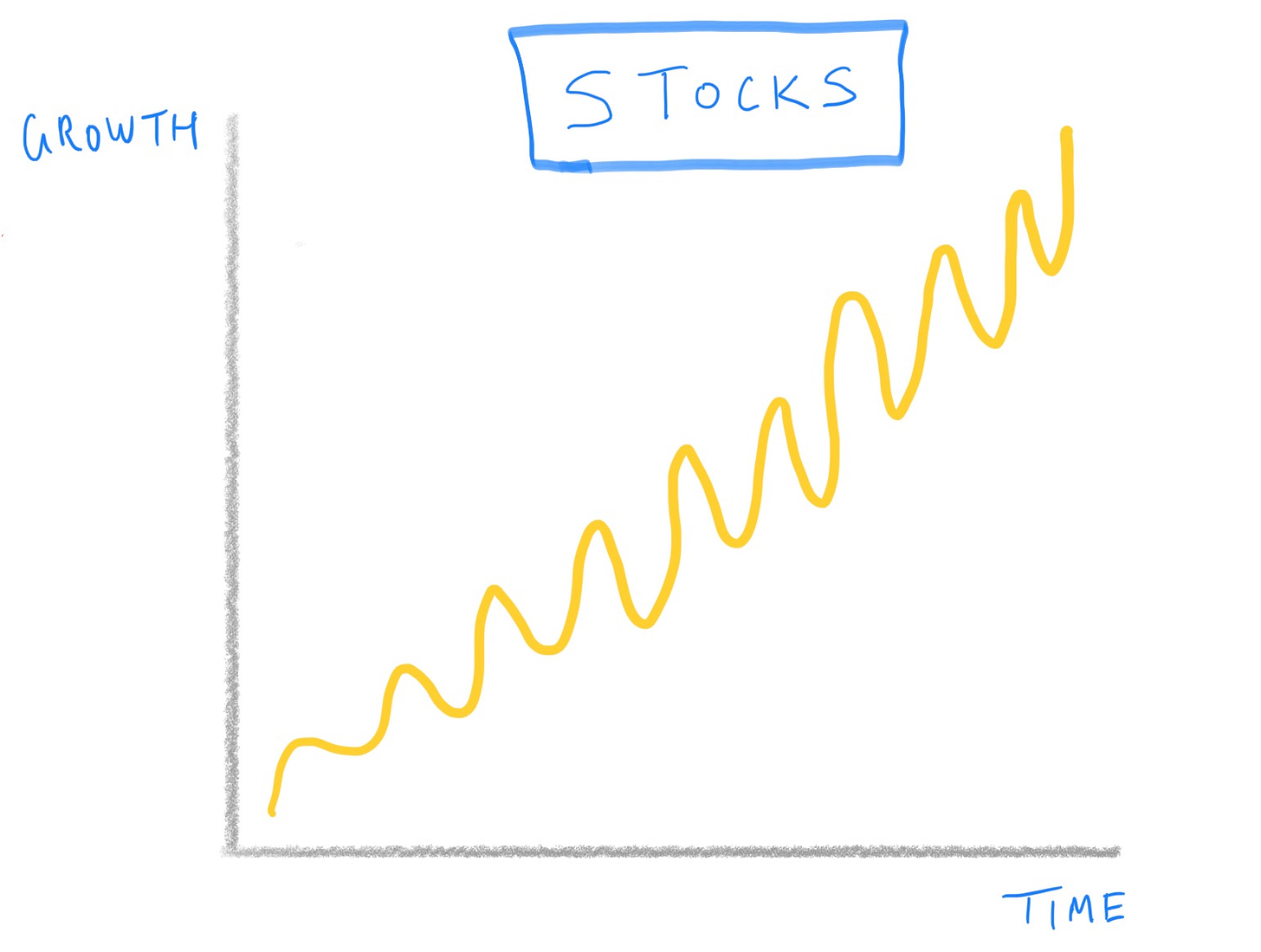

As a whole, stocks tend to grow faster over time, but they can be volatile (meaning they can go up and down a lot). Stocks may progress as follows:

Be mindful that individual stocks have both skyrocketed and many have plummeted to be worthless.

Bond

A bond is a loan to a company or government institution. A municipal bond is a loan to a government institution. For example, when a city needs to build new roads and needs some money, they’ll issue bonds to raise money. A corporate bond is a loan to a company. Companies may issue bonds when they need more money for a new project or initiative.

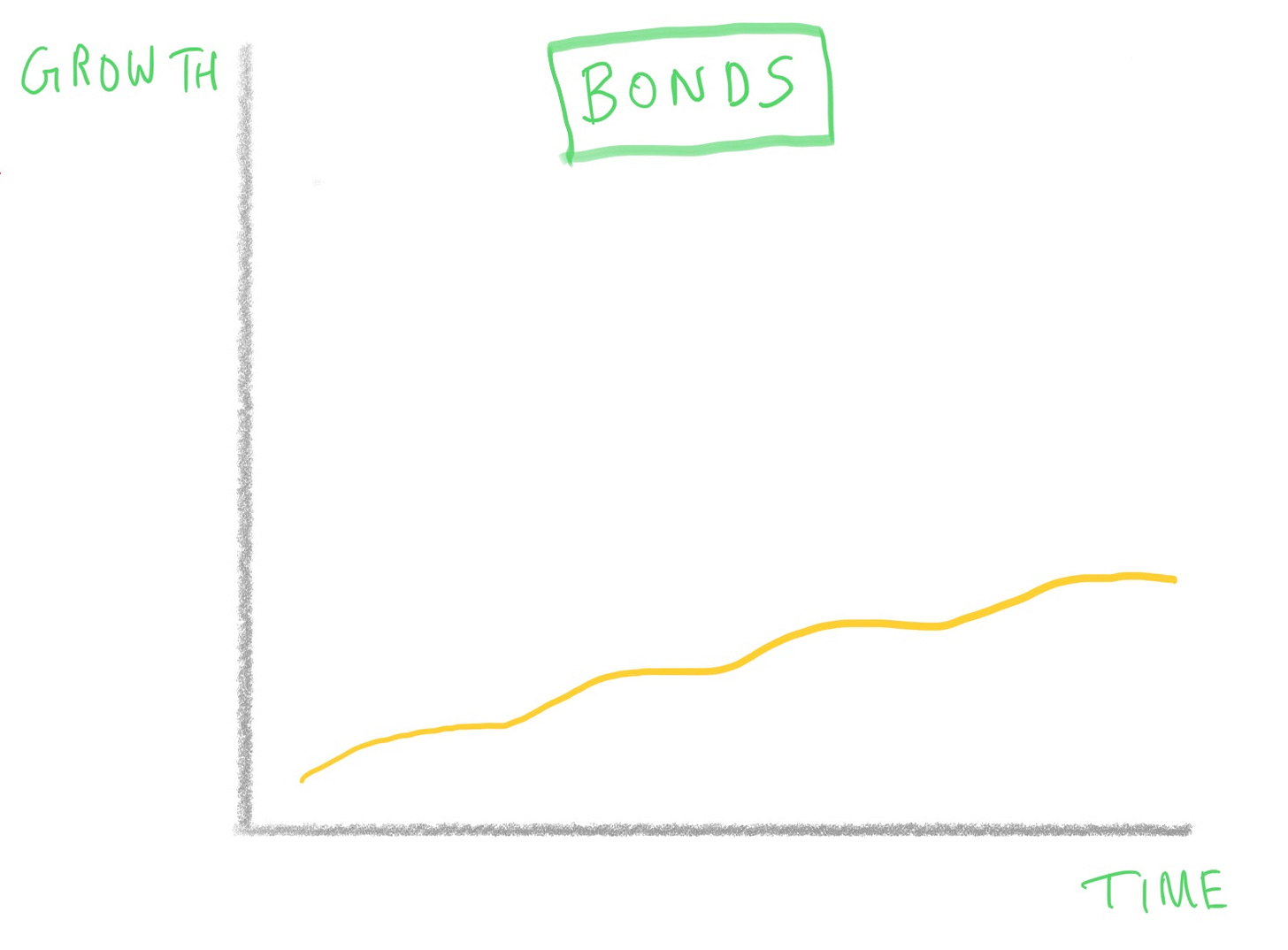

Bonds tend to grow slowly over time but are usually more stable. Bonds may progress as follows:

Mutual Fund

There are thousands of companies out there that issue stocks. You have the freedom to buy one or as many as you like. One way to buy stocks or bonds is through a mutual fund. A mutual fund is a collection of stocks and/or bonds packaged all together. A mutual fund is like those big variety bags of candy. If each individual candy was a stock or bond, the bag together is the mutual fund.

There are tons of mutual funds out there that collect various stocks and bonds together based on a myriad of guidelines, goals, and purposes.

Most mutual funds have some minimum amount that must be purchased. For example, some mutual funds require at least $3,000 to start. On the other hand, you can buy a stock for whatever it’s selling at and however much or little as you’d like.

Index Fund

An index fund is a type of mutual fund that collects stocks or bonds which are automatically picked and maintained based on an objective standard or list. One way to think of an index fund is a collection of candy based on a rule (e.g., every chocolate candy bar). For example, there are some index funds that contain every single U.S. stock.

Exchange Traded Fund (ETF)

ETFs are a collection of stocks and/or bonds that can be purchased one share at a time (as opposed to a minimum dollar amount). Like Index Funds, an ETF usually tracks something, like 500 of the biggest U.S. companies.

Brokerage Account

A brokerage account is an account used to buy and sell stocks and bonds. Like a checking account is to a debit card and checks, a brokerage account is to stocks and bonds.

[2] Define and triage the Packs you have available (a.k.a. 401k, IRA, etc.)

Every climb requires a pack(s) (a.k.a. account(s)) to carry your essential items. There are different account types available based on your employer and income level. Different packs have different tax implications. Just like you’d have a variety of packs for a long climb, you’ll likely have a variety of account types based on your goals. You can have multiple account types at one financial institution.

So what kinds of packs are available? Here are the most common ones:

Employer Provided Packs: 401(k), 403(b), etc.

Often, your employer will provide a pack for you. On top of that, your employer may provide some benefit for you to put money in the pack, like an employee match. For example, an employer may say for every 3% you put into the pack, they will match it with another 3%.

If something like this is available to you, it is the first and best place to begin investing.

Standard Brokerage Account

When you open a brokerage account, it usually comes with a standard brokerage account pack. This pack gives you complete freedom but has minimal tax advantages. Complete freedom means you can put as much or as little money in as you like, and you can take out as much or as little money as you like, whenever you want.

But, the money put into the standard brokerage account has already been taxed (usually from a paycheck). When you withdraw money, you are taxed on the growth. However, all taxes are at capital gains rate, which is usually less than income tax rates (at least for now).

In summary: complete freedom with no tax advantages.

Traditional Individual Retirement Account (Traditional IRA)

A Traditional IRA is a pack intended to help you retire that limits your freedom but gives you an immediate tax benefit. The benefit is that you can put money into the pack that is not taxed. Money contributed reduces your taxable income for the year. However, you are taxed when you take money out.

For this really nice benefit, there are some rules the government puts on the money. The rules are updated and slightly change over time, but generally they are: you can only put a certain amount of money in each year; you will incur a penalty to take the money out before the age of 59 ½, and you can’t make too much money.

ROTH Individual Retirement Account (ROTH IRA)

A ROTH IRA is a pack intended to help you retire that limits your freedom but gives you a tax benefit later. Money that goes into the account is already taxed, but then it’s not taxed when you take it out.

Similar to a Traditional IRA, a ROTH IRA has limitations and guidelines. However, there’s a bit more flexibility to take money out.

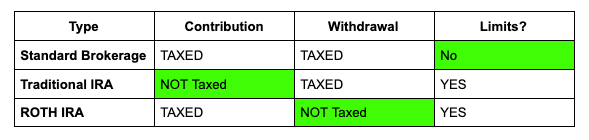

COMPARING VARIOUS PACKS

Here’s how these accounts roughly compare to one another:

Notice that each account type has at least one key benefit (highlighted in green). But, the benefit comes with a cost (the unhighlighted cells).

TRIAGE AVAILABLE PACKS

Now that we’ve defined the different account types, it’s time to triage which one to pick and fill. Here’s a rule of thumb:

Tier 1: Max out 401K up to employer matching (e.g., if your employer matches up to 3% of your contributions, contribute the full 3%).

Tier 1.5: Max out Health Savings Account (HSA) if you have one (this is a bit more complicated, but is a way to have funds go in tax-free and come out tax-free, as long as it’s used for medical expenses).1

Tier 2: Max out ROTH if you have 10+ years until retirement

Tier 3: Max out Traditional if ROTH isn't possible or nearing retirement

Tier 4: Max out Standard Brokerage account or go back and max out 401(k) if available

There are nuances in all this, but this should help you get started.

[3] Get Your Own Pack (a.k.a. open a brokerage account)

Get a feel for the packs you have available. Again, many employers provide you a pack in the form of a 401k or 403b. I always recommend everyone has their own pack (e.g., Standard Brokerage Account, Traditional IRA, and/or ROTH IRA). If you don’t already have a Standard Brokerage Account, go open one.

There are two institutions I recommend for brokerage accounts: (1) Vanguard and (2) Betterment.2 Vanguard is the cheapest, best, and most aligned with your interests. But it’s ugly and has a clunky interface. Betterment is a bit more expensive but it’s beautiful and simple. It’s way easier to automate things and set various goals in Betterment. So, if you’re looking for ease, pay a bit more and go with Betterment. If you’re willing to learn the ropes a bit and save some money, go with Vanguard.

[4] Fill your Pack (a.k.a. The one-fund and two-fund options to buy)

Let’s get ready to fill some packs (e.g., buy funds). Your goals should dictate the amount of risk you’re willing to take. Remember, stocks tend to be more risky but also grow faster. Bonds tend to be more stable, but tend to grow slower. So, based on the timeline of your goals, you want to have a ratio of stocks and bonds. The more time you have, the more risk you can take, therefore the greater percentage of stocks you should have. But, as the due date gets closer, you should reduce risk by having less stocks and more bonds.

Now, all that may feel super complicated and way beyond you. But, it can be easily done by purchasing just one fund.

One Fund to Rule Them All: Target Date Fund

There are 3,781 stocks and over 10,000 bonds in the U.S. stock market. How in the world do you know which one to buy? And, once you buy it, how do you sell it at the right time? And, how do you adjust it as you get older?

Thankfully, there is one fund (yes, one fund!) that will do it all for you! Automatically! It’s called a Target Date fund.

A Target Date fund provides a ratio of stock and bonds based on your timeline. And the target fund automatically changes the ratio of stocks and bonds as it gets closer to your deadline! Here’s how it works: you pick the year of your deadline. Let’s say you want to save up to buy a house in 10 years. Choose a target date fund that is 10 years from the current year (i.e., 2031). Then, regularly put money into the fund.

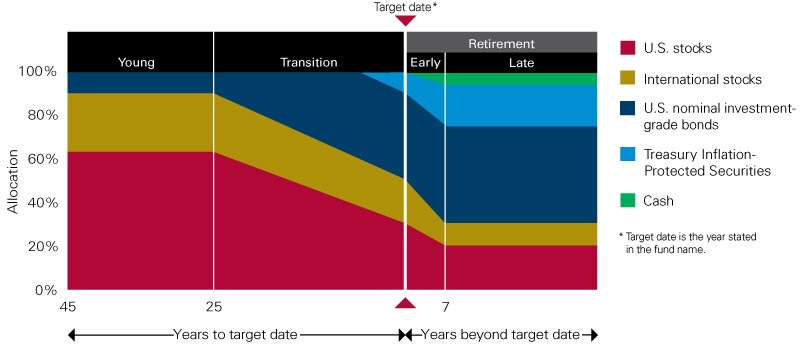

The graph below gives you a sense of how a Target Date fund changes as the deadline gets closer:

The red and yellow are stocks. The blues are bonds. Notice how stocks decrease and bonds increase as the target date gets closer.

If you’re just getting started, this is the one-fund I’d recommend. It’s simple, straight-forward, inexpensive, with no maintenance. Just put money in consistently, sit back, and relax.

At this point, you’re welcome just to skip to the end and call it a day.

But, if you want a slightly advanced strategy, add one more fund.

Two-Funds: 60% Target Date + 40% Small Cap Index

If you’d like to take on more risk with the potential of more gain, then put 60% of your funds in the Target Date Fund. With the remaining 40% buy the Small Cap Index Fund. I’ve linked to Vanguard’s, but any institution will have it. So what in the world does Small Cap mean? Well, there are Small, Medium, and Large Cap companies. Cap stands for market capitalization and is a measure of how much a company is worth. Small Cap Companies are worth between $300 million and $2 billion (e.g., Williams-Sonomoa). Mid Cap Companies are worth between $2 billion and $10 billion (e.g., Chipotle). Large Cap companies are worth more than $10 billion (e.g., Apple).

So why buy the Small Cap fund? Well, smaller companies tend to have more room to grow. The larger you get, the harder it is to get bigger and bigger. Having exposure to smaller companies gives you the ability to participate in the potential growth.

Notice though that small cap funds aren’t tiny. They are usually at least worth $300 million. This isn’t your mom and pop store or a penny stock. These are usually established businesses with lots of room to grow.

Advanced Strategies

There are a handful of more complex strategies out there that I like. If you’re interested, feel free to send me an email and I’ll break it down.

Conclusion

After months of figuring out who you want to be, how you’re going to invest, and what your goals and approach to investing will be, we’ve finally put it all together. You can finally go out and invest with confidence.

If you’ve got questions or thoughts on anything here, don’t hesitate to drop me a quick note (hit reply or email josh@introemail.com).

But, before you think it’s all done, there’s just a bit more to cover. Next time: the secrets of investing like a boss.

Closing Randomness

JL Collins was the first guy to help me really see the secret sauce that makes Vanguard unlike any other investment firm out there. You can read that piece here. Simply: Jack Bogle created Vanguard so that the customer owns the company, which means the interests of the customer and company are perfectly aligned.

This move, for customers to own Vanguard, meant millions of people had access to great funds at a super low cost. And it meant that Bogle passed on billions (that’s with a “b”) of dollars of personal wealth so the common person like you and me could have more. As one writer put it: “he’s the biggest undercover philanthropist of all time.”

Warren Buffet said this about Bogle:

If a statue is ever erected to honor the person who has done the most for American investors, the handsdown choice should be Jack Bogle. For decades, Jack has urged investors to invest in ultra-low-cost index funds. In his crusade, he amassed only a tiny percentage of the wealth that has typically flowed to managers who have promised their investors large rewards while delivering them nothing – or, as in our bet, less than nothing – of added value. In his early years, Jack was frequently mocked by the investment-management industry. Today, however, he has the satisfaction of knowing that he helped millions of investors realize far better returns on their savings than they otherwise would have earned. He is a hero to them and to me.3

By far my favorite article of the last month: David Perell’s “Why You’re Christian.” A self-proclaimed “religious atheist,” David makes a strong argument that, no matter what we believe, much of our assumed foundation comes from Christianity.

If you’re interested in a nerdy deep-dive on using HSA’s as an investment strategy, check out “HSA: The Ultimate Retirement Account” by the MadFientist.

As a heads up, the Betterment link will give you and me a reward if you sign up.