Invest Like a Boss #5: Secrets

Enough + Give: The cheat codes to happiness

Thanks for diving into the intro community. If you know any other smart and curious folks, make my day by inviting them along!

If you haven’t yet subscribed, there’s no better time than right now.

You’ve made it to part 5 in a series called Invest Like a Boss! We’re cutting through the noise to discover how to invest in the stock market…really well.

So far, we’ve covered:

Who do you want to be? Wealthy > Appearing rich.

Do you have the Preqs done? In other words, are you out of debt, have a 6 months emergency fund, and spending less than you earn?

How will you invest? Boring > Flashy.

What are you investing for? Define your goals. Name them, Determine the amounts, timeframes, and Risk tolerances.

Getting Started: The automatic, silver bullet fund

The Secrets of Investing [Today!]

To officially close down the Investing like a Boss series, we’re going to uncover a few secrets of investing. These secrets are like little keys that unlock doors to enjoying life. They may seem simple enough on the surface, but actually require serious focus to pursue. In some ways, they’re kind of like the holy grail to the good life.

Here’s how we’ll break it down:

Enough: figure out what it is for you.

Giving is more Rewarding than Accumulating

Let’s get right to it.

[1] Enough: Figure Out What It Is for You

Enough. Simple word. Nearly impossible to nail down.

One of the biggest secrets in life is figuring out what Enough is for you. Enough is capitalized and in italics because it’s one of the best cheat codes to life. It’s a place few have ever reached. If you can figure out what Enough is, you’ll catapult yourself ahead of 99.9% of people in the world.

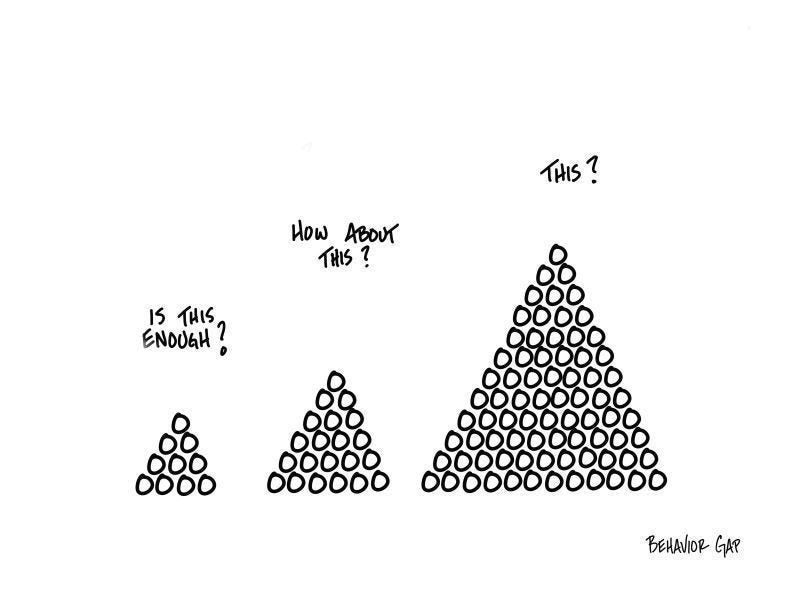

Lots of people want to be good at investing to get rich. And, honestly, wisely investing over a long period of time is a great way to accumulate wealth. But where does it stop? How do you know when you’ve made enough? For some, they climb the mountain of investing their whole life and never get to the top because they always feel like there’s just a little bit more to go.

This endless climb happens in all areas of life. We constantly find ourselves thinking if we just had what that other person had, we’d arrive. And, even if we kind of figure things out internally, we live in a time where everyone is telling us that we need what they have. There’s corporations and influencers and tons of other entities that drop a ton of brain power and dollars to convince you that your life would be better if you’d just get this thing, or upgrade to that product, and on and on it goes.

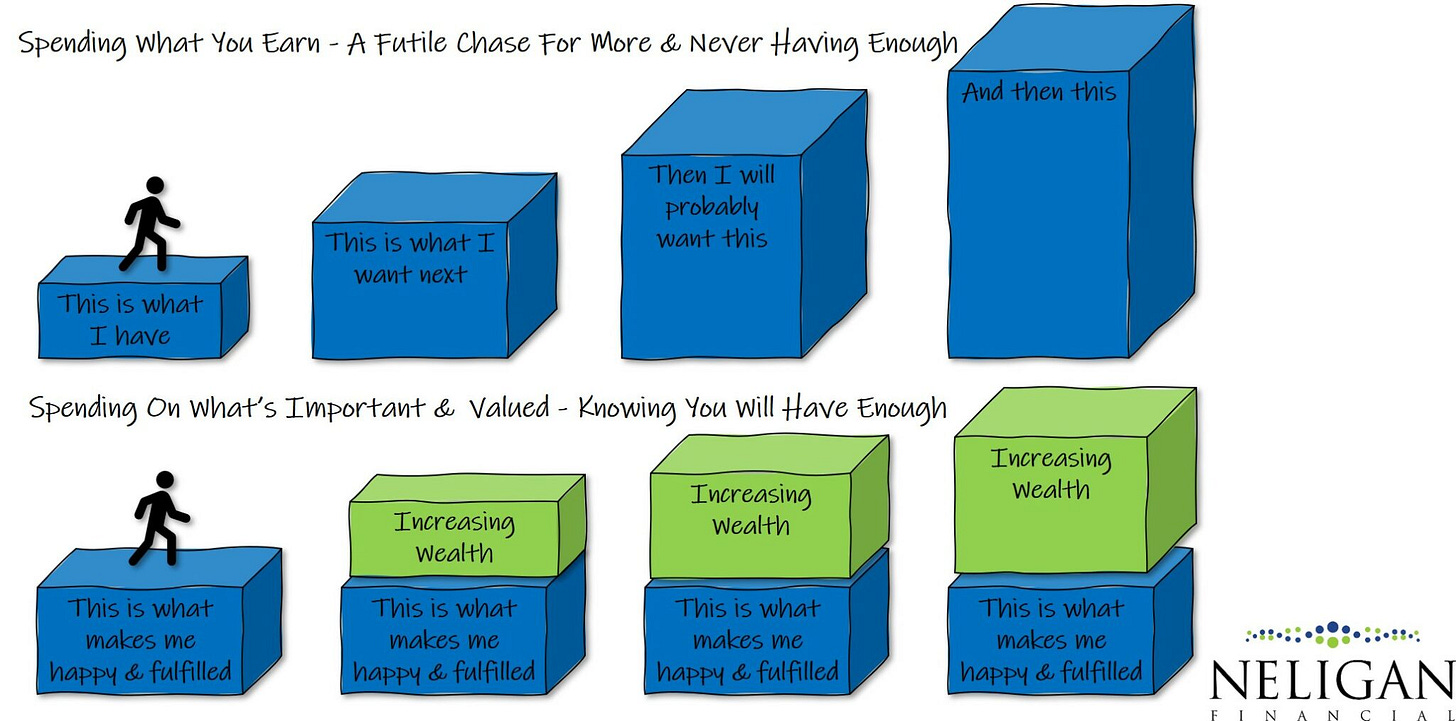

But always striving and never arriving is a recipe for frustration. When does it end? Where’s the finish line? Is it death? That feels a bit morbid and deflating. Perhaps your life feels like the top half of this graphic:

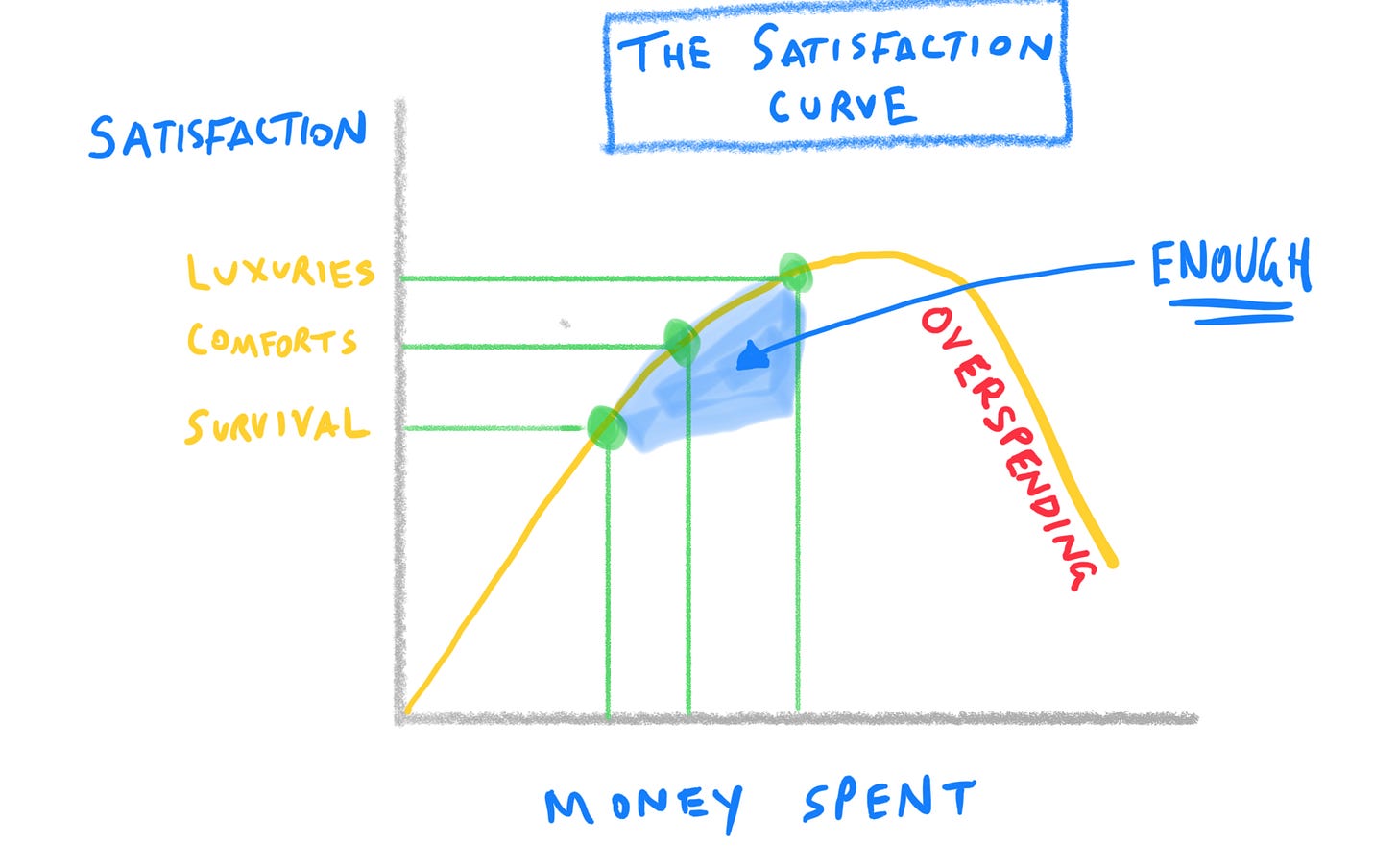

Now, check out the Satisfaction Curve.1

On the left side of the chart is satisfaction. On the bottom is money spent. Now, the immediate assumption is that the more money we have to spend, the more satisfied we will be. But that’s not the case.

The first yellow dot represents our satisfaction when we go from not being able to survive to survival. Imagine not having food and then having enough money for food. That’s a huge leap in terms of satisfaction.

Then, as you progress, you may have money for comforts. So you go from just surviving to comfort. It’s an increase in satisfaction, but relative to the huge jump of not surviving to surviving, it’s just a bit more.

And the same is true for luxuries. If we can afford luxuries, great. But the degree of increased satisfaction is marginal.

What we’re aiming for is enough.

Because, there’s a downward slope to spending called overspending. It’s where we get into debt, finding our identity in things that leave us less and less satisfied. Or, maybe you have endless amounts of money, so debt isn’t an issue. Overspending can be like the endless climb, either finding definition in the number of zeros in your bank account or the experiences you can have or the cool things you can accumulate. The problem is that it’s never enough.

Instead, what if you figured out what Enough was in advance? What is enough house or enough car? What is enough money? How much is enough saved up? Really think about it.

What if you figured out what you value and designed a lifestyle around those values that’s within your means? Of course it wouldn’t have to be a straight jacket. Life happens. Change is inevitable. But still, getting out in front of defining Enough allows you to be in control rather than everyone else. I recently read that Gen Z values autonomy and flexibility like crazy. If you don’t know what Enough is, you’ll always be somewhat controlled by others and end up confined to their aspirations for you.2

So, how do you figure out what Enough is for you?

Start with your values. What’s important to you? What do you want your life to be about? What do you want to be known for? Think about your life personally, as a family (if you have one), as a community, and as a citizen of Earth.

How do those values impact major life decisions? I quickly think of the highest dollar moments: (1) college choice, (2) house, and (3) car(s). Those three categories will have an outsized impact on your life (let alone your ability to invest).

Consider your means. Get a feel for your income trajectory. We all have constraints. Your income is one of them. Design a lifestyle that fits in it (oh, and be sure to account for taxes.)

Figure out how much money you need each year to support your Enough lifestyle.

Set financial finish lines for income and welath.3 Income is how much money you need each year to cover your expenses (see #4 above).

Wealth is how much you need for long-term goals (e.g., retirement, college education, weddings, etc). Roughly determine your wealth target by multiplying the amount in #4 above by 25. If you’ve stocked that much away in stocks/bonds, you should be able to float yourself indefinitely.4

Cap your lifestyle around those finish lines. Regardless of how much you make each year or accumulate in your life, don’t change how you live because you have access to more. It’s a climb that never ends.5

Find someone to hold you to what you set. It’s going to be hard to maintain your Enough lifestyle when you’ve got more. It may help to have a friend that knows what you’re going after and can keep you true to your word.

Yeah, I know, that sounds crazy. It almost seems like thoughts from another world.6 Honestly, you just need to get halfway down the road of defining Enough and you’ll be miles ahead in pursuing your values and life in a way most can’t.7

[2] Giving is More Rewarding than Accumulating

The DNA of the universe includes the principle that accumulation without distribution is dangerous.

Think about a river. It flows and flows. But what if it empties into a giant lake that has no outlet. That lake looks nice, but is also fragile because if pollutants get in, it’s really hard to get rid of them.8

Or consider your own life. Imagine if you accumulate calories (i.e., eat), day in and day out, but never move. It’s a recipe (no pun intended) for disaster. The calories we take in are meant to fuel us outward.

Money is the exact same way. If we just set out to accumulate money in our lives and only spend it on ourselves, it often leads to diminishing satisfaction via overspending (see Satisfaction Curve above).

The way to reach and stay at Enough is to build a lifestyle that gives money away for the good of others.9

A guy who retired at the age of 29 after saving $600,000 and living off of $25,000 each year talks about the deeply satisfying and happy moment when he gave a chunk of change away:

I have known for years that I wanted to start doing this, but on the day that I actually dropped all those checks into the mailbox, I felt a great lightness. That night, I fell asleep with the happy peace that comes from letting go of just a bit of selfishness and fear. After noticing not even the slightest regret, I can see that it will become even easier as time goes on.10

Why is giving such a good thing? Essentially because it’s an easy way to help us consider more in life than just ourselves. See, the problem with accumulating money is that we’re constantly thinking about what I need. It’s all about me.

But when we give, we start thinking about others: other people, other issues, other initiatives. Our minds and hearts begin lifting out of the immediate and onto other things that are important but may not seem as obvious. We begin realizing that it’s better to be a part of something grander than ourselves, that our lives are meant for more.11

So, if giving is more rewarding than accumulating, how do you start?

Give it a try. Find a cause or a person or something that you believe in and just give some money away.

Over time, look to make it a habit. Become a monthly sponsor of something.

Set goals to out-give what you’ve done in the past.

There are millions of causes to give to in the world. A good place to start with considering what you value or what you want to be a part of promoting or changing. Many people of faith give to their local church. Those who have had a personal or close experience with a particular issue will give towards that.12

One of the secrets to money is that it’s not all about accumulating. Giving money away is one of the most satisfying things you’ll ever do.

Conclusion

And there you have it, two secrets of investing like a boss. They don’t fit into the traditional nuts and bolts of stocks and bonds. Instead, the secrets recognize that we’re not just brains on a stick, but complex emotional, relational people that experience the world holistically.

Now get to it! Practice some of these principles. Make a move. You’re future self will thank you a million times over.

And, if you’ve got any thoughts or questions, don’t hesitate to send me a note.

Closing Randomness

Jack Bogle, the hero from part 4, didn’t say much about giving. But this article highlights a few things. his philosophy of philanthropy was “When you live somewhere, you have an obligation to that community.” And he said, “The best rule for philanthropy is to give until it hurts, as much as you can, because none of us can get through life all by ourselves.”

Take these 8 word to heart to invest like a boss:

This is mostly taken from the Fulfillment Curve on page 24 of Vicki Robin and Joe Dominguez’s book, Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence.

From the article, “A Guide to Gen Z Through TikTok Trends, Emojis, & Language” by Rex Woodbury.

This idea comes from Gregory Baumer and John Cortines’ book, God and Money: How We Discovered True Riches at Harvard Business School.

This concept is called the 4% rule. You can roughly withdraw 4% from your investments each year without affecting the principle because those investments grow, on average, about 7% each year over time. So, if in #4 above you determined that your lifestyle required $100,000 each year, then 25 times that is $2.5 million. You could withdraw 4% of $2.5 million (=$100,000) every year and almost never run out of money.

If you’d like to learn more about the 4% rule, you can read one of the original studies (or an abbreviated form of it), but this might be a thorough and accessible first step. Oh, and the graph here.

$60,000 to $95,000 income per year seems to be the magic range for happiness. According to a 2018 Purdue University study, that’s the income range where emotional well-being and life satisfaction peaks. After $105,000 of income, happiness levels decrease.

See a summary of these thoughts here.

Though lots of people talk about it. See Khe Hy’s article “Why having “enough” feels so elusive.” There’s an entire community called Financial Independence Retire Early (FIRE) that’s built on figuring out Enough. Or this fun little post, “How Much Is Enough?”

When I say “most,” I’m not just talking about people who are financially poor. Some of the most wealthy people in the world are the most unsatisfied, unhappy, and lacking in contentment.

Nature isn’t my forte, so figuring out what an Endorheic Basin was took a bit of googling and a Wikipedia deep dive.

Even Jesus says something similar in a book called Acts chapter 20 verse 25, “...it is more blessed to give than to receive.”

Pete Adney said this in an article “Notes on Giving Away my First $100,000.” Pete is better known as Mr. Money Mustache, one of the most popular people in the Financial Independence Retire Early community.

This is at least one reason why people love rooting for a sports team. It gives a person a mission to be a part of that is grander than ourselves (e.g., winning the championship). It weaves us closely with others that are with us (e.g., other fans of the same team) against a force that must be overcome (e.g., another team and their fans).

I have a friend whose sister has MS. Each year he bikes 100 miles to raise awareness and money for MS research.